If you’re thinking about entering the cryptocurrency space for the very first time, the internet is now full of third-party exchanges and cold wallets like Tangem Wallet that allow you to buy and sell digital tokens at the click of a button.

While some focus on low trading fees or an extensive list of supported coins, others such as Coinbase are leaders in the simplicity race. In other words, if you want to buy cryptocurrencies such as Bitcoin or Ethereum but you’ve got no experience in using exchanges, then Coinbase might be your best port of call. Albeit, this will potentially come at the expense of higher fees?

Nevertheless, we’ve created the ultimate Coinbase review so that you can determine whether or not the platform is right for you. We’ve covered everything from how Coinbase works, what it allows you to do, the number of coins it supports, fees, payment methods, and more.

Let’s start by finding out what Coinbase actually is.

What is Coinbase?

Launched in 2012 and based in San Francisco, California – Coinbase is an exchange broker that facilitates the buying and selling of cryptocurrencies. Led by CEO Brian Armstrong, Coinbase is often used by inexperienced investors that are looking to purchase cryptocurrencies for the first time, not least because the platform supports everyday payment methods such as debit/credit cards, bank transfers, and even PayPal.

To illustrate just how big Coinbase has become, the platform claims to have signed up surplus of 30 million customers since it launched in 2012, with more than $150 billion worth of cryptocurrency assets traded along the way. This has been further amplified by Coinbase’s international expansion, with the platform now supported in more than 103 countries worldwide.

There is often confusion as to whether Coinbase is a broker or an exchange, as the two terms are typically used interchangeably. In effect, they are both. On the one hand, the platform’s core brokerage services allows customers to buy and sell cryptocurrencies directly from Coinbase. However, as the company also offers a more traditional exchange platform too – Coinbase Pro, it effectively operates as both a broker and an exchange.

On top its main consumer-based services, Coinbase is also gaining a strong foothold in the institutional space. This is especially true of the platform’s custodianship services, which seeks to offer institutional-grade security on cryptocurrency holdings.

In fact, it was recently reported that Coinbase is now experiencing institutional demand of between $200 million and $400 million per week. With cryptocurrencies arguably still in their infancy, this number is only expected to grow.

In terms of the platform’s regulatory standing, Coinbase is registered as a Money Service Business with FinCEN, and it complies with all respective anti-money laundering and terrorist financing regulations. This is why all customers must be identified when using Coinbase. Outside of its US operations, Coinbase is authorized to operate as a Money Service Business by the UK’s Financial Conduct Authority (FCA).

So now that we’ve covered the basics of what Coinbase is, in the next section we are going to explore how the buying and selling process works.

How do you buy and sell Cryptocurrencies at Coinbase?

As the primary feature of the ever-growing Coinbase product range, buying and selling cryptocurrencies is super easy. In fact, this is one of the key reasons that it has attracted so many users over the past seven years. Irrespective of experience, making a purchase can be done with ease.

Moreover, although the number of cryptocurrencies supported by Coinbase is still relatively small, the platform acts as a simple gateway to purchase small and micro-cap digital tokens on other exchanges.

In order to show you how it works, we’ve broken down the main set-up process below.

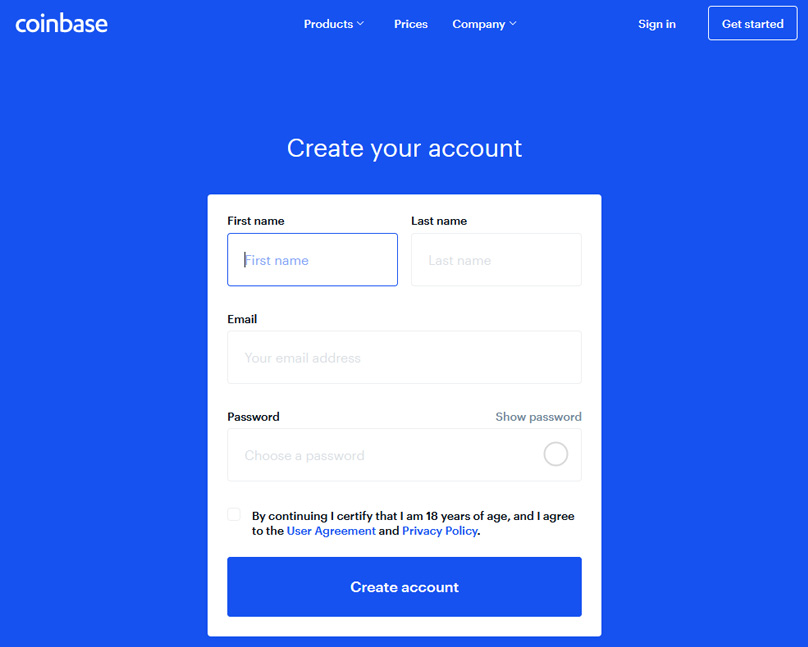

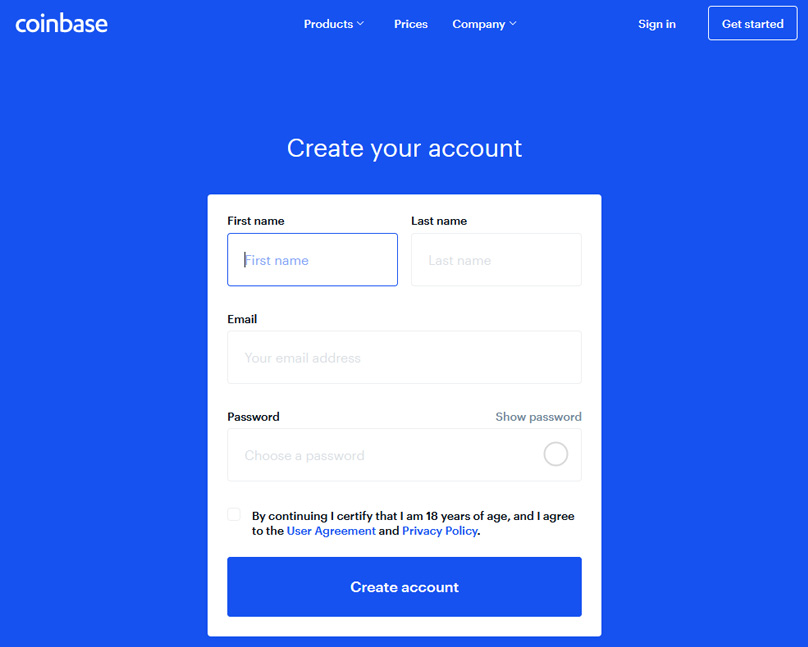

Step 1: Open an Account

You will first need to head over to the official Coinbase homepage. At the top right-hand side of the page you will need to click on ‘Get Started’ to open an account.

You will need to enter your first and second name, alongside your email address. Coinbase will then send you an email, which you will need to verify.

Next, you will need to select whether you want to open an ‘Individual’ account or ‘Business’ account. Unless you’re looking to buy and sell significant volumes, go with the former.

Step 2: Confirm Your Mobile Number

You will now need to enter your personal mobile number. Coinbase will then send you an SMS message containing a unique code, which you’ll need to enter on-screen to verify that you are the rightful owner of the device.

This is absolutely fundamental, as you will need your mobile device to access key account features, such as logging in or withdrawing funds.

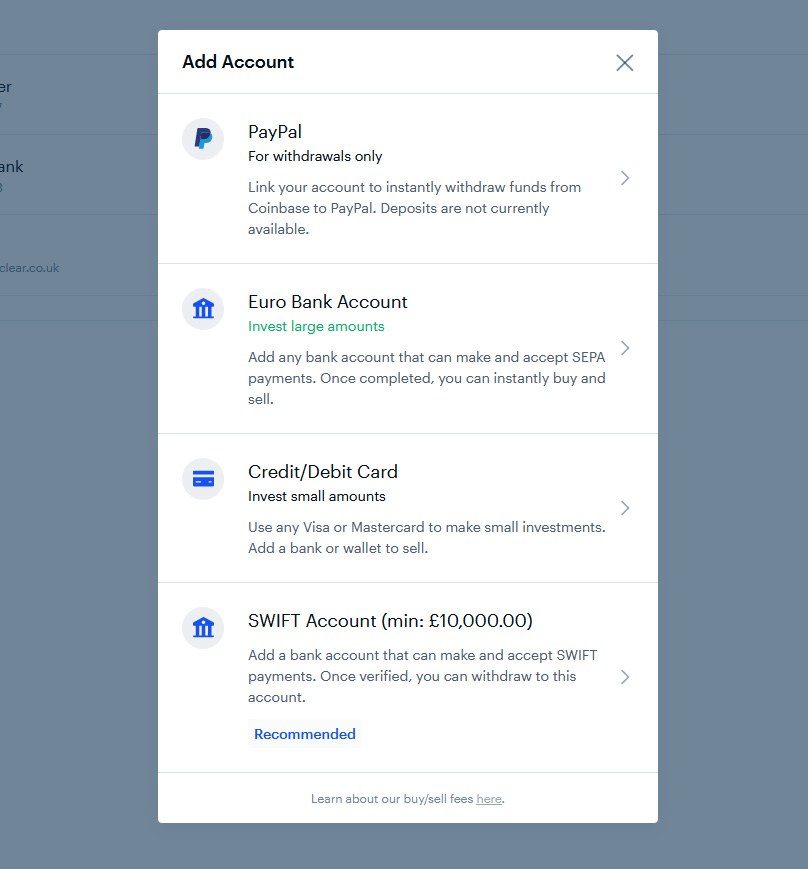

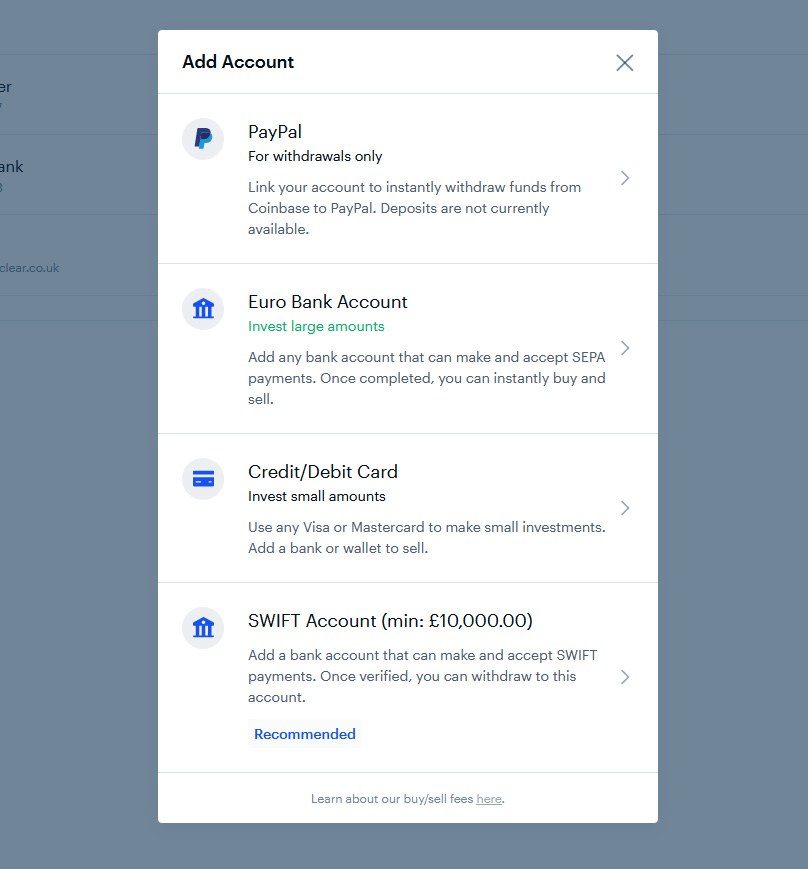

Step 3: Set-Up Your Preferred Payment Method

As you will be asked to deposit funds, you will need to set-up a payment method. Your options will depend on where you are located, although in most cases this covers a debit/credit card and bank account.

You will also be asked to enter the billing address linked to your prefered payment method.

Step 4: Verify Your Identity

Not only is Coinbased authorized by FinCEN and the FCA, but the platform has an excellent relationship with key regulators such as the Securities and Exchange Commission (SEC).

As such, the platform takes its anti-money laundering responsibilities very seriously. This means that you will now need to go through a basic KYC (Know Your Customer) process to verify your identity.

In order to do this, you’ll need to upload a copy of your government issued ID. This needs to be a passport, driver’s license or national ID card.

Coinbase utilizes highly advanced verification tools to analyze your ID document, so they should be able to validate the upload within less than a minute.

Step 5: Confirm Your Payment Method

To conclude the account set-up process, you will need to verify your chosen payment method to confirm you are the true owner. If opting for a debit card, Coinbase will process two small charges from your card. You’ll need to log in to your online bank and confirm the last two digits of these charges.

Alternatively, if opting for a bank account, you need to make a small transfer into the account details specified by Coinbase. Once you’ve done the above, you’re now ready to buy your first ever cryptocurrency.

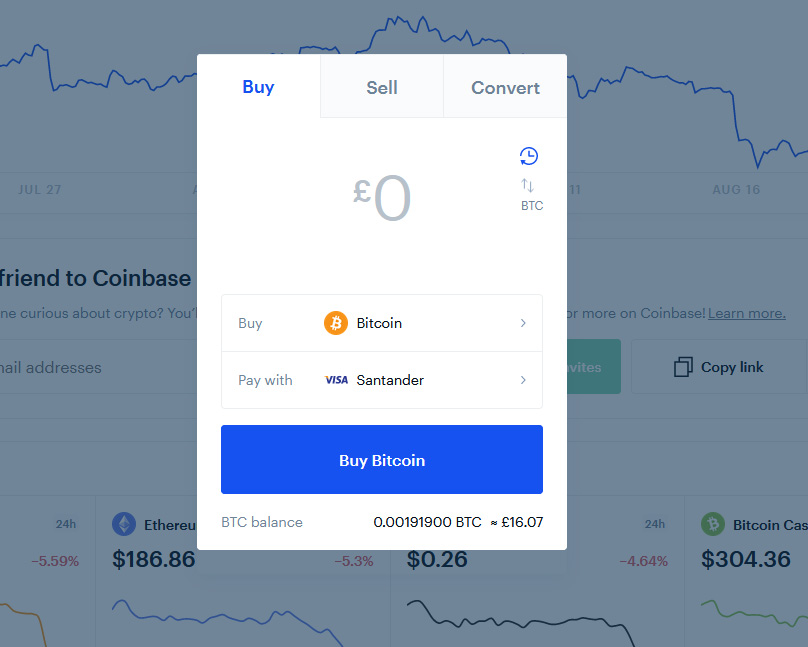

Step 6: Make a Purchase

Now that you’re all set-up, click on the cryptocurrency that you want to buy, enter the total USD (or local currency equivalent) amount that you want to purchase, and pay for the transaction with your verified payment method.

The purchase will be executed immediately, meaning that the digital coins will be stored safely in your Coinbase account. Now you have the option of withdrawing them to a private wallet, sending them to another cryptocurrency exchange, or simply leaving them in your Coinbase account to sell at a later date.

So now that we’ve explained how the buying process works at Coinbase, in the next section we are going to explore what cryptocurrencies you can buy.

What Cryptocurrencies Does Coinbase Support?

Up until last year, Coinbase was known as an exchange platform that was very selective in the cryptocurrencies it listed on its site. However, the platform has since expanded its reach by becoming slightly less conservative with new coin listings. As such, it is now possible to buy and sell 17 different cryptocurrencies

Check out the list of supported coins below.

- BAT

- BTC

- BCH

- BSV

- DAI

- EOS

- ETH

- ETC

- LINK

- LTC

- REP

- USDC

- XLM

- XRP

- XTZ

- ZEC

- ZRX

Coinbase Pro supports a number of additional coins that are not tradeable on the main Coinbase platform, which we’ve listed below. These will be tradable against a number of other digital assets, such as Bitcoin or Ethereum.

- ALGO

- CVC

- DNT

- GNT

- LOOM

- MANA

- MKR

- ZIL

How Much Does it Cost to Trade at Coinbase?

One of the most important factors to consider when using a cryptocurrency broker is the fees you will pay to buy and sell coins. As we will breakdown in greater detail below, Coinbase is often regarded as one of the more costly cryptocurrency brokers in the industry. Not only in the case of trading fees, but certain deposit methods are costly, too.

Trading Fees

Coinbase has a somewhat complex pricing structure when it comes to buying and selling cryptocurrencies, not least because it uses either a fixed-fee or variable percentage fee.

Firstly, and irrespective of your location, any buy or sell orders under $200 will come with a fixed fee. This starts at $0.99 for orders under $10, up to a maximum of $2.99 for orders of between $50 ad $200. Anything above $200 and you will revert to a fixed percentage fee. The amount that you pay will depend on your chosen payment method.

For example, if you already have funds in your Coinbase account, and the funds are sufficient enough to cover the amount you want to buy, then you will pay a fee of 1.49%. This is subsequently deducted from the amount of cryptocurrency you receive. For example, if you purchase $1,000 worth of Bitcoin, your 1.49% fee of $14.90 would leave you with $985.10 worth of cryptocurrency.

This is actually very expensive, especially when you look at the fees employed by other leading cryptocurrency exchanges. For example, the likes of Binance charge just 0.1% every time you want to buy or sell a coin, which is considerably cheaper. However, deposits and withdrawals in fiat currency are much more limited at Binance in comparison to Coinbase, so you need to take this into account.

Alternatively, if you choose to make an instant cryptocurrency purchase using your debit or credit card, then the fees are even higher. This will cost you 4.99% of the total transaction amount. For example, a $500 debit card purchase would cost $24.95 in fees. This is to counter the threats of a potential debit/credit chargeback, as well as the cover the costs of processing fees imposed by the card issuer.

Deposit and Withdrawal Fees

Firstly, if you want to use your debit or credit card, you will need to make an instant cryptocurrency purchase. In other words, you can’t use your card to simply leave the funds in your account for a later date. However, you can do this if opting for a bank account deposit.

The amount that you pay will vary depending on your location. If you’re based in Europe and subsequently using the SEPA network, deposits are free, and withdrawals cost a mere €0.15.

In the UK, a bank wire deposit is also free, and the withdrawal costs just £1. If you’re from the US, ACH deposits and withdrawals a free, while a more traditional wire transfer will cost $10 and $25 for deposits and withdrawals, respectively.

Alternatively, if you’re from the UK, Eurozone, Iceland, Liechtenstein, Norway, Switzerland or the US, you can also make Paypal deposits and withdrawals for free.

Coinbase Pro

If you decide that you want to use the Coinbase Pro platform to exchange digital currencies, a maker-taker fee model is utilized.

Note: A market ‘maker’ is somebody that provides liquidity for Coinbase Pro, while a market ‘taker’ is an ordinary trader that utilizes the liquidity already available on the exchange.

Market taker fees will start at 0.25% for trading volumes of less than $100,000, up to a minimum of 0.05% for volumes of $1 billion or more. Makers will pay 0.15% for everything under $100,000, with fees being scrapped for trade volumes of $100 million or more.

Who is Eligible to use Coinbase?

As is industry standard in the cryptocurrency exchange arena, your eligibility will be determined exclusively by the country you reside in. While at the time of writing the platform supports 103 countries, not all locations have the capacity to place buy and sell orders. On the contrary, most countries are only able to convert one cryptocurrency into another.

If you want the option of being able to use everyday payment methods such as a debit/credit card or bank account to buy and sell coins, then you will need to be based in one of the following countries.

- Andorra

- Australia

- Austria

- Belgium

- Bulgaria

- Canada

- Chile

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Gibraltar

- Greece

- Guernsey

- Hungary

- Iceland

- Ireland

- Isle of Man

- Italy

- Jersey

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Mexico

- Monaco

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- San Marino

- Singapore

- Slovakia

- Slovenia

- Spain

- Sweden

- Switzerland

- United Kingdom

- United States

Is Coinbase Safe?

Even if you’re yet to enter the cryptocurrency space personally, it’s likely that you’ve heard about third-party exchanges getting hacked. In fact, although the numbers are estimates at best, it is believed that more than $1.3 billion has been hacked from cryptocurrency exchanges in total. Taking into account that the phenomenon is just over 10 years old, this is a considerable amount of money.

As such, the safety of your funds should be your primary concern when choosing a cryptocurrency exchange for the first time. The good news for you is that arguably – Coinbase is one of the most secure cryptocurrency exchanges in the industry.

Below we’ve broken down the main security features that will help keep your funds safe.

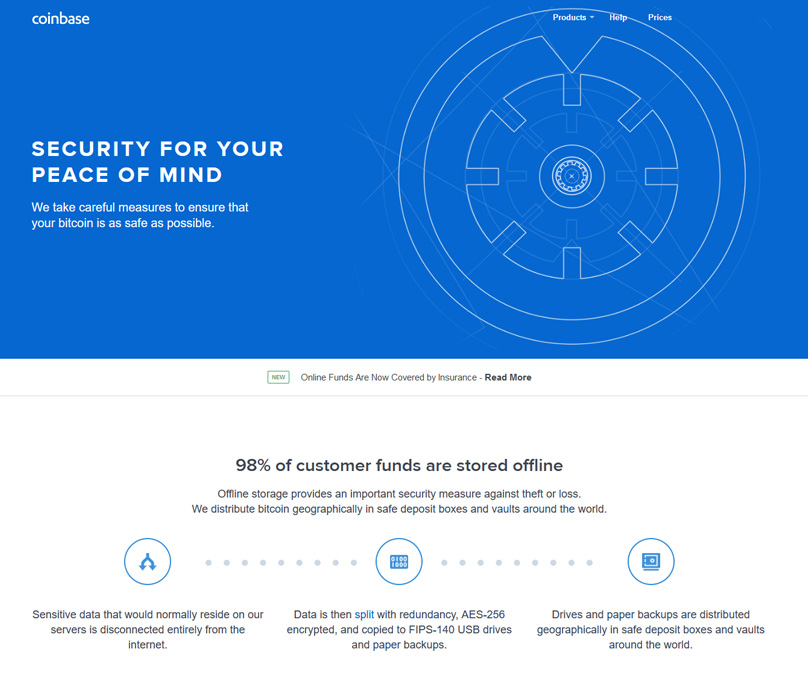

Cold Storage

A good starting point is the platform’s decision to keep the vast majority of its user funds in cold storage. For those unaware, this means that digital coins such as Bitcoin are kept offline via a hardware device. As such, they are virtually immutable to an external malicious attack, not least because the funds are never connected to a server.

With 98% of customer funds held in cold storage, this acts as a major safeguard. The remaining 2% is subsequently used to facilitate Coinbase’s core services, such as the buying and selling of coins, and executing withdrawals.

Account Security

From the perspective of the user, Coinbase offers a number of notable security features to ensure that you mitigate the risks of unauthorized account access. First and foremost, you will be required to install two-factor authentication (2FA) via your mobile device. This means that every time you login, you will need to enter a unique code that can only be obtained from your phone. In this sense, somebody would need both your account password and mobile phone to compromise your account.

Device and IP whitelisting also act as a crucial safeguard. This is where you will be required to pass an additional security step to gain access to your Coinbase account, in the event that you are logging in from a new device or IP address.

Coinbase Vault

While keeping your funds in the Coinbase wallet comes with its own security features, larger balances should be placed in the Coinbase Vault. In a nutshell, this allows you to set-up a 48-hour lock-up period on any future withdrawal requests. At any point in time before the 48-hour period passes, you as the account owner can cancel the withdrawal.

This would be highly beneficial in the event that a malicious actor was able to access your Coinbase account and went on to make a withdrawal. As you would be notified by email when the withdrawal request was made, this would give you sufficient time to act.

FDIC Insurance

In a relatively surprising move for a cryptocurrency exchange, Coinbase also offers FDIC protections on its USD wallets. This means that if the company ever ceased to exist, your balance would be protected upto the first $250,000.

Take note, this is only offered to US customers that store their real-world funds in their Coinbase USD wallet. Anything outside of this won’t be covered by the FDIC. For customers outside of the US, real-world funds are held in segregated custodial bank accounts.

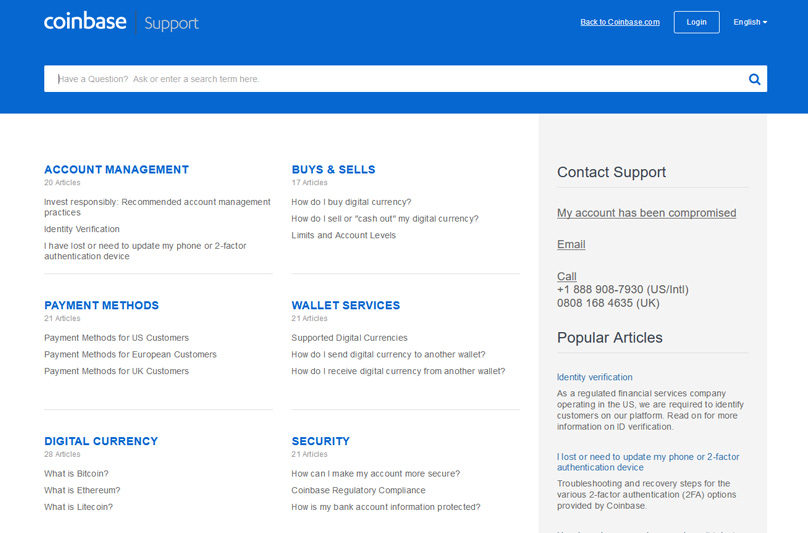

Customer Support at Coinbase

When the Coinbase platform grew to unprecedented heights at the turn of 2018, the company made the decision to increase its customer support team by the hundreds. As such, customers now have a plethora of options when it comes to speaking with a member of the customer service team.

If you’re from the UK, you’ll need to dial 0808 168 4635

For everyone else, including the US, you’ll need to dial +1 888 908-7930

You can also send an email to Coinbase, although this needs to be done via an online contact form.

As long as your concern isn’t linked to a potential account compromise, the vast majority of questions and concerns can be solved via the platform’s highly extensive help centre. This also includes an AI-bot that can quickly point you in the right direction of where the seek assistance.

Coinbase Review: The Verdict?

In summary, it is clear to see why Coinbase has attracted a significant customer base that now exceeds over 30 million customers. The overarching selling point is that the platform makes it an ultra-seamless process to enter the cryptocurrency market for the very first time.

By going through a quick and simple account registration and verification process, you can buy and sell popular coins like Bitcoin and Ethereum at the click of a button. Moreover, as popular payment methods such as a debit/credit card, bank transfer and even PayPal are supported, this makes the buying process even more straightforward for newbie entrants.

However, it must be noted that in terms of trading fees, Coinbase is a little more expensive that other players in the cryptocurrency exchange arena. At an average fee of 1.49% for all orders over $200, this can quickly eat into your profits. Furthermore, if using a debit or credit card, these costs are further amplified to a somewhat staggering 4.99% per buy order.

Ultimately, while there are cheaper options in the market, you also need to remember that Coinbase has an excellent track-record when it comes to keeping user funds safe. Not only does the platform offer a number of stringent security safeguards, but it also has an excellent relationship with key US regulators such as the SEC and FinCEN.

All in all, we would recommend Coinbase as an excellent starting point for anyone wanting to get involved in purchasing cryptocurrencies – it’s super easy to use, very secure and backed by the best reputation in this industry.