In this time of climate crisis, investors’ interest in sustainable businesses has been mounting. The Environmental, Social, and Governance (ESG) data from organizations has become one of their basis for assessing the risks of capital investments. And the reason for that is simple, knowing how a business help mitigate climate change shows their transparency, accountability, and care for the environment and humankind in general.

With that, the popularity of sustainability reporting through the years paved the way for the emergence of different ESG frameworks. And we are here to discuss four things you should know about them. So, if you’re new to the industry and still figuring out how to start your business and attract investors, better stay tuned!

#1 The Importance of ESG Reporting and Its Frameworks

The first thing you should know before delving deeper into the different ESG reporting frameworks is their essence. Why do they matter?

ESG frameworks are just simple sets of guidelines to help businesses make a firm ESG report efficiently. The said report shows a company’s data on environmental, social, and governance factors, which can help attract investors. An organization’s commitment and transparency in mitigating climate change help build the stakeholders’ trust in their work values. That said, businesses that do ESG reporting unlock more opportunities to raise capital.

#2 Different ESG Reporting Frameworks And Standards

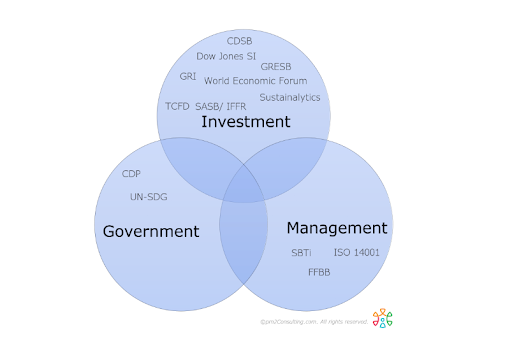

When it comes to ESG reporting frameworks, you have to understand that there are three stakeholders they can cater to: investors, government, and management. That said, the frameworks have different structures to follow.

Let’s take a closer look at some of the mostly-used frameworks to give you more insights.

Investment

These ESG frameworks are geared toward assisting investors in making informed choices on the sustainability-related performance of a possible investment. They additionally favor monetarily obvious pursuits.

Global Reporting Initiative (GRI)

It is an independent and international body supporting a corporation’s understanding, creation, and dissemination of sustainability measures for years and counting. The standards, commonly referred to as “GRI standards,” are suitable for all sectors in the industry and are available on their website for free download.

Sustainability Accounting Standards Board (SASB)

The SASB’s main objective is to create guidelines that help businesses inform investors about sustainability. Its standards assist businesses in gathering and disseminating crucial information that influences the firm’s business decisions and elucidates the financial impact of sustainability.

Toward the end of 2020, the GRI and SASB declared they would work together to encourage more trust among reporting organizations. The two well-known frameworks released study findings and a helpful guide in April 2021. Together, the GRI standards target a more extensive scope. Meanwhile, the SASB rules delve deeper into information and data relevant to their industry through a financial lens.

Task Force on Climate-Related Financial Disclosures (TCFD)

It is made to develop uniform climate-related financial risk disclosures for businesses with a predominately financial learning interest. The TCFD knowledge library has comprehensive instructions on how to follow their requirements and advice for reporting. Check it out on their website.

Government

These ESG reporting frameworks serve as guidelines for national and regional governments, assisting them in offering sustainability-related services and support to their constituents.

Carbon Disclosure Project (CDP)

The CDP is a global nonprofit organization that supports companies in lowering their GHG emissions, protecting forests, and preserving water resources. It has one of the most comprehensive data sources on how the industry operates on decarbonization and environmental preservation.

UN Sustainable Development Goals (UN SDGs)

It is a framework that has 17 objectives for 2030. It deals with poverty, inequality, the environment, economic growth, anti-corruption, labor, and human rights.

Management

These ESG frameworks translate sustainability-related concepts into concrete actions and effects that organizations can influence or have an impact on.

International Organization for Standards (ISO)

It is a framework that gives businesses access to international standards for a huge range of ESG-related industries.

International Organization for Standards (SBTi)

This one encourages businesses to set science-based targets and increase their competitive edge when transitioning to a low-carbon economy.

#3 Factors to Consider When Choosing A Framework

Since there are numerous frameworks, how would you know the right one? Here are some things to look out for when selecting the framework for your ESG reporting:

Your Industry

Understanding your company’s industry will help you figure out the suitable framework, especially since most frameworks have industry-specific standards.

Target stakeholder

Another thing to consider is who you are reporting to. Is it investors? The government? or the management? By knowing that, you’ll be able to select a framework that meets the standards set by your target stakeholder partner.

Geography

The standards in ESG reporting may vary per region. For example, the EU’s Corporate Sustainability Reporting Directive (CSRD) does not meet the UK’s constantly changing disclosure requirements.

Framework Coverage

Each framework has different scopes or levels of focus. Knowing the frameworks’ coverage will help you choose and gain insight into situations where businesses may be able to report to many frameworks using the current data.

#4 Challenges in Implementing the Framework

If you think the problem ends with choosing a framework, the implementation is also one thing that you should look out for. Here are a few issues that you might encounter:

Different Scoring Systems

“How do we determine our ESG score?” is the first question you will always ask after selecting a framework.

The numerical evaluation of an organization’s performance on environmental, social, and governance (ESG) issues is known as an ESG score. It is your basis to monitor your progress from internal and external perspectives.

However, of course, the score depends on the framework you’re using, so the question you should ask must be, “What is our ESG score using [X framework/standard]?

Data Quality

You must know that ESG reporting is voluntary, so the accuracy may still be forged in some ways. And unfortunately, this will continue until it becomes like financial reporting for publicly traded corporations, which is standard practice.

Lack of Harmonization

There is a serious lack of uniformity among the literally hundreds of ESG reporting systems that exist today. This inconsistency causes hassle and mismatch, which led other companies to stop ESG reporting.

Final Words

ESG reporting offers a variety of advantages. And by knowing its importance, the frameworks available, strategies in selecting one, and acknowledging the challenges, your company’s goal of sustainability and financial opportunities are feasible. With more companies joining this cause, we can hope for a low-carbon future.

Discover more from Start Entrepreneur Online

Subscribe to get the latest posts sent to your email.