Whether you are a seasoned cryptocurrency investor or yet to make your first digital asset purchase, chances are you’ve come across Binance. This Malta-based cryptocurrency exchange has gained prominence as one of the largest platforms for daily trading volumes, offering access to over 540 individual crypto-to-crypto pairs. With its recent expansion into supporting real-world fiat currency deposits and withdrawals, Binance’s growth trajectory seems set to continue. rent a car in thiruvalla

What is Binance?

Launched in late 2017, Binance is a third-party exchange platform founded by Chinese national Changpeng Zhao (CZ). In under two years, it has become one of the industry’s largest cryptocurrency exchanges, often facilitating over $2 billion in daily trading activity.

Initially, Binance focused solely on crypto-to-crypto transactions. However, recent developments, as discussed later, have introduced limited support for bank account and credit card deposits. The platform’s popularity can be attributed to its extensive list of supported cryptocurrency pairs, low trading fees (further reduced with Binance Coin holdings), and involvement in various initiatives such as launching a blockchain bank and partnering with the Malta Stock Exchange.

Nevertheless, Binance has risen to fame for a number of reasons. Firstly, the platform offers a hugely extensive lists of supported cryptocurrency pairs. While this of course includes hallmark coins like Bitcoin and Ethereum, this also includes small-to-micro cap tokens. Secondly, trading fees are extremely low at Binance. While standard trading fees average a very competitive 0.1%, this can be further reduced for those holding the platform’s proprietary digital asset – the Binance Coin.

Outside of its core exchange platform, Binance has its fingers in a number of other pies. For example, it was announced last year that the company was looking to launch the world’s first ever blockchain bank in Malta. The platform also signed a Memorandum of Understanding with the Malta Stock Exchange with the view of facilitating the trading of digital securities.

Binance is also renowned for its dedication to helping those in need. Through its Binance Charity Foundation initiative, the platform has spear-headed a number of charitable projects. This includes a recent campaign to help females in Uganda who suffer from period poverty.

So now that we’ve covered the basics, in the next section of our review we are going to show you how Binance works in more detail.

How Does Binance Work?

Binance allows users to buy, sell, and trade various cryptocurrencies. Here’s a simplified overview of the main steps:

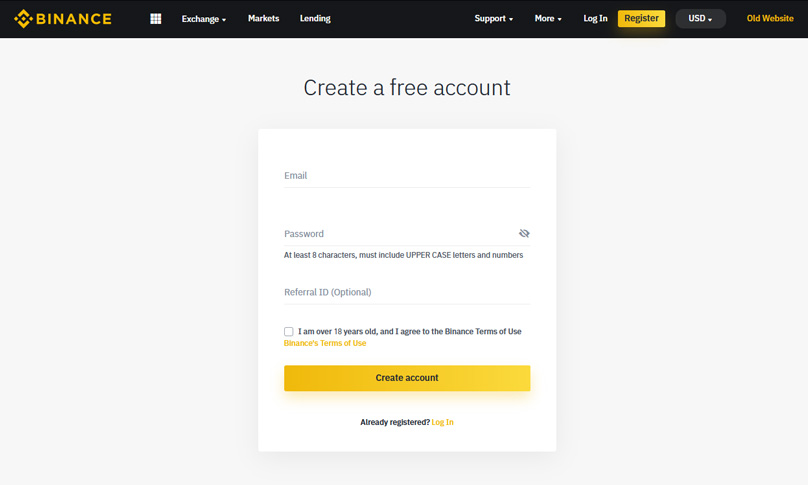

Step 1: Open an account

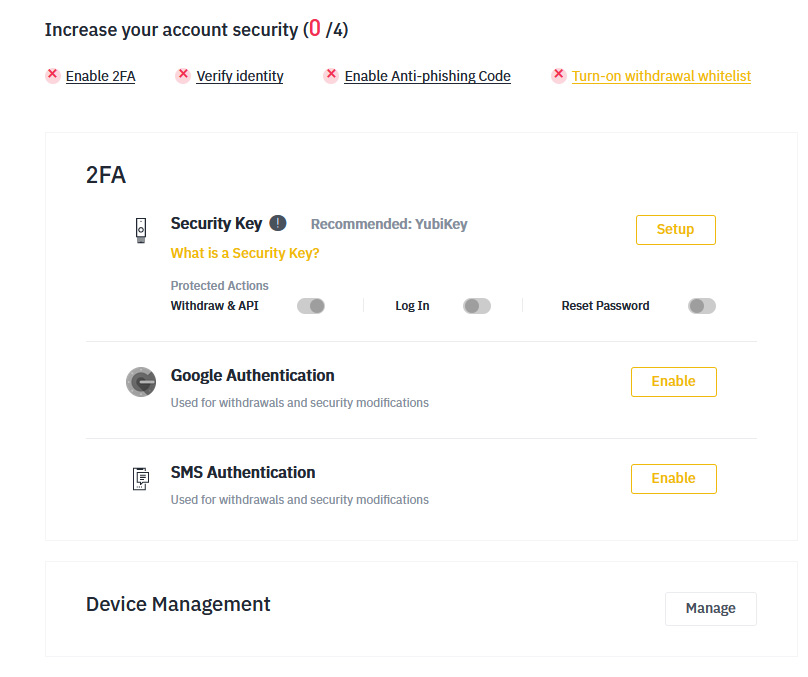

Visit the Binance homepage, provide an email address (if dealing only with cryptocurrencies), and set up two-factor authentication for added security.

Step 2: Set up two-factor authentication

In order to secure your account, Binance will ask you to set-up two-factor authentication (2FA). This means that you’ll need to install an application like Google Authenticator on to your phone. Subsequently, each and every time you want to log in – or perform key account functions like a withdrawal request, you’ll need to enter a unique code that can only be found on your phone.

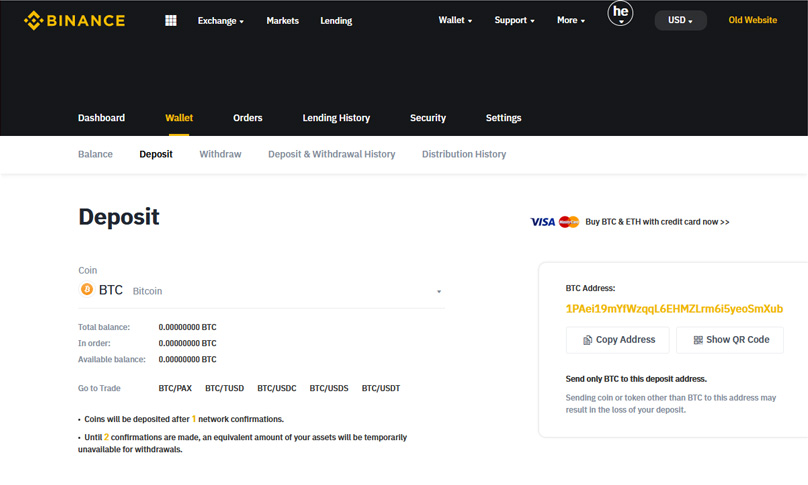

Step 3: Deposit coins

Although a select number of nations can now use a credit card or bank account to deposit funds, we’ll make the assumption that you’re looking to deposit with a cryptocurrency.

If a fiat currency deposit is something you want to explore, you’ll need head over to the ‘Funds’ section of your account and follow on the on-screen instructions (if available).

Nevertheless, on the deposit page, you’ll need to scroll through the long list of coins that are supported, and click on the one that you want to deposit into Binance. You can use this address to send funds to that you purchased on another platform ie Coinbase.

Copy the unique wallet address that is provided to you, and use that to transfer the funds from your private wallet.

Step 4: Trade

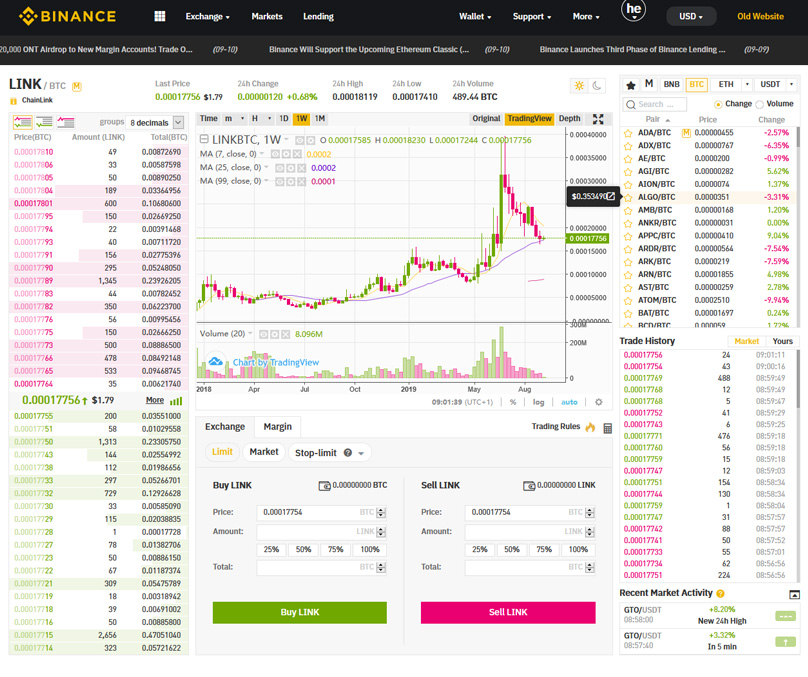

Once your cryptocurrency deposit has been credited – which usually takes no more than 10-20 minutes, you are then ready to start trading. Hover over the ‘Exchange’ button at the top of the screen, and select whether you want the ‘Basic’ or ‘Advanced’ trading platform. If you’re just starting out, then go with the former.

You now have access to over 540 individual trading pairs. If the coin that you want to purchase is not directly paired against the cryptocurrency you deposited with, you’ll need to make an additional trade.

For example, if you deposited with Bitcoin Cash, but you’re looking to buy a smaller cap ERC-20 token that isn’t paired with Bitcoin Cash, then you might need to exchange it for Bitcoin or Ethereum first.

When you complete your trade, your newly purchased coin will now be available in your Binance account. You can either keep it in your Binance account, or withdraw it to an external wallet.

Binance also offers an API which allows you to connect your account to a number of Crypto Trading bots and allow them to trade on your behalf, automating your strategy and hopefully profiting from the bot’s trades.

So now that you know how Binance works, let’s explore what cryptocurrencies the platform supports.

What Cryptocurrencies Does Binance Support?

As we noted earlier, one of the main attractions for avid cryptocurrency traders is that the platform has one of the largest lists of supported coins. While the main players – notably Bitcoin, Ethereum, Bitcoin Cash, Litecoin and EOS, are of course supported, Binance is also good for much smaller, lower-cap tokens.

Rather than listing each and every trading pair available on Binance, we’ve instead listed the 164 individual cryptocurrencies that can be bought and sold on the platform at the time of writing.

If you want to see what pairs are available against your chosen coin, you can view this at CoinMarketCap.

- Aave

- AdEx

- aelf

- Aeron

- Aeternity

- Agrello

- Aion

- AirSwap

- Algorand

- Ambrosus

- Ankr

- AppCoins

- Ardor

- Ark

- Augur

- Bancor

- Basic Attention Token

- Binance Coin

- Binance GBP Stable Coin

- Bitcoin

- Bitcoin BEP2

- Bitcoin Cash

- Bitcoin Diamond

- Bitcoin Gold

- BitShares

- BitTorrent

- BlockMason Credit Protocol

- Blox

- Bluzelle

- Bread

- Cardano

- Celer Network

- Chainlink

- Cindicator

- Civic

- Cocos-BCX

- Contentos

- Cosmos

- com

- CyberMiles

- Dash

- Decentraland

- Decred

- Dent

- DigixDAO

- district0x

- Dock

- Dogecoin

- Dusk Network

- Eidoo

- Elrond

- Enigma

- Enjin Coin

- EOS

- Ethereum

- Ethereum Classic

- Etherparty

- Ethos

- Everex

- Fantom

- Fetch

- FunFair

- Gas

- Genesis Vision

- Gifto

- GoChain

- Golem

- Groestlcoin

- GXChain

- Harmony

- Holo

- Horizen

- HyperCash

- ICON

- iExec RLC

- Insolar

- IOST

- IOTA

- IoTeX

- Komodo

- Kyber Network

- Lisk

- Litecoin

- Loom Network

- Loopring

- Lunyr

- Mainframe

- Matic Network

- Metal

- Mithril

- Moeda Loyalty Points

- Monero

- Monetha

- Nano

- NavCoin

- Neblio

- Nebulas

- NEM

- NEO

- Nexus

- Nucleus Vision

- NULS

- OAX

- OmiseGO

- Ontology

- Ontology Gas

- OST

- Paxos Standard Token

- PIVX

- et

- POA Network

- Polymath

- Populous

- Power Ledger

- Pundi X

- QLC Chain

- Qtum

- Quantstamp

- QuarkChain

- Raiden Network Token

- Ravencoin

- Red Pulse Phoenix

- Ren

- Request

- Ripio Credit Network

- Selfkey

- Siacoin

- SingularDTV

- SingularityNET

- Skycoin

- SONM

- StableUSD

- Status

- Steem

- Stellar

- Storj

- Storm

- Stratis

- Streamr DATAcoin

- Syscoin

- Tael

- THETA

- Theta Fuel

- Tierion

- Time New Bank

- TRON

- TrueUSD

- USD Coin

- VeChain

- Verge

- Viacoin

- VIBE

- Viberate

- Waltonchain

- Wanchain

- Waves

- WePower

- WINk

- XRP

- YOYOW

- Zcash

- Zcoin

- Zilliqa

How Much Does it Cost to Trade at Binance?

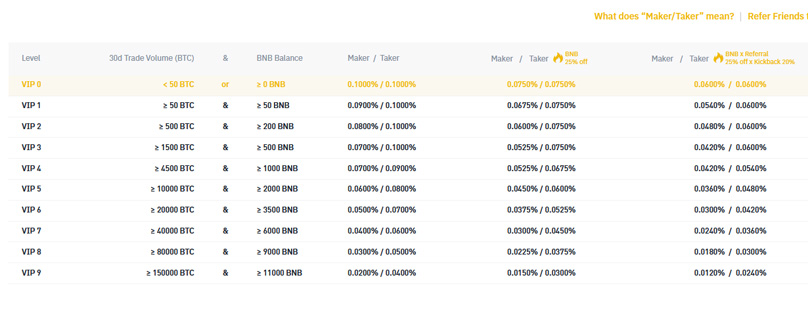

Although Binance does offer a maker/taker fee structure, the standard trading fee that you will pay is 0.1%. This will be charged every time you buy and sell a coin. If you are a market taker – meaning that you simply use the liquidity that is already available on the platform, then you can reduce this down to 0.09% if you trade more than 500 BTC (or cryptocurrency equivalent) in a 30 day period.

The lowest fee available for market takers is 0.04%, albeit, you would need to trade at least 150,000 BTC in a single month.

At the other end of the spectrum, market makers – which provide the platform with liquidity, get an initial fee of 0.1%, too. However, for trades of more than 150,000 BTC per month, this can be reduced down to 0.02%.

Irrespective of how much you trade, the fees charged by Binance are some of the lowest available in the cryptocurrency exchange arena. In even better news, you have the opportunity to reduce these fees further by holding the Binance Coin.

Reduced Trading Fees via Binance Coin

If you hold a balance in the platform’s native Binance Coin, then you can use this to pay your trading fees. In doing so, you will be offered a reduction of 25%. As such, your 0.1% standard trading fee is reduced down to 0.075%.

The discounted fees available via the Binance Coin will reduce over time. While this was previously 50%, the next reduction will take the discount down to 12.5%.

Who is Eligible to Trade at Binance?

Binance is a global cryptocurrency exchange that has traditionally accepted users from all nation states. The main reason for this is that users are trading crypto-to-crypto products and thus, regulations are somewhat unclear. This is especially true when you consider that new users are only required to provide an email address to get started.

However, the platform recently announced that it would be restricting US passport holders from using its exchange. The main reason for this is that Binance is looking to launch a dedicated exchange for US citizens that complies with all regulatory requirements. As such, if you’re from the US and you want to use Binance, you’ll likely need to wait until the domestic exchange is launched.

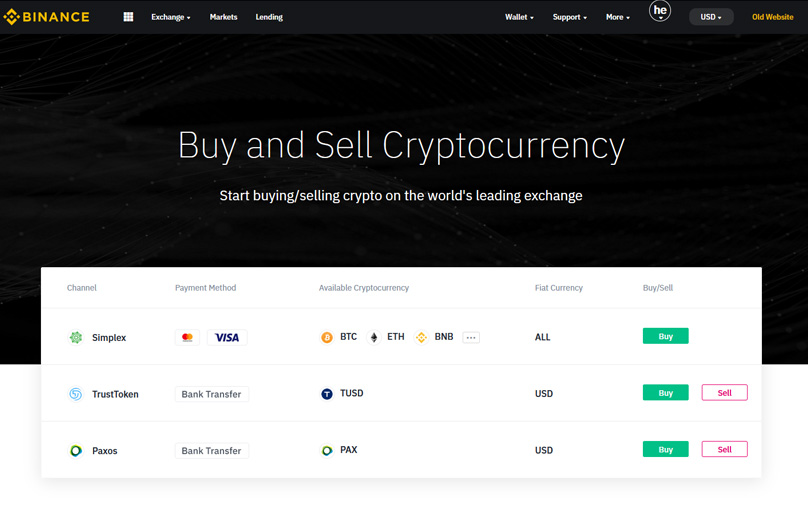

Deposits, Withdrawals and Payments

Although Binance has always been known as a cryptocurrency-only exchange, the platform is now able to facilitate fiat currency deposits and withdrawals. At the time of writing, this is available via credit cards or a bank transfer. Not all locations are supported, so you are best advised to check this first.

Credit Card

If you’re looking to use a traditional credit card to purchase coins, you can now do this directly from the Binance website. Both Visa and MasterCard are accepted.

The platform notes that while payments can be accepted from credit cards of all currencies, if the native currency is anything other than USD or EUR, then an additional charge might apply. In terms of the standard processing fees, this comes at a cost of 3.5% ($10 minimum). This is slightly lower than industry counterpart Coinbase, which charges 3.99%.

At the time of writing, you can use your credit card to purchase the following coins:

- Bitcoin

- Ripple

- Binance Coin

- Ethereum

- Litecoin

- Bitcoin Cash ABC

Bank Transfer

If you’re looking to deposit and withdraw funds via a bank transfer, then this can be facilitated via the platform’s Binance Jersey off-shoot. At the time of writing, supported countries mainly consist of the UK and Europe, alongside a number of other jurisdictions such as Turkey, Singapore, Australia, New Zealand, and the United Arab Emirates.

To get funds into your Binance account via a bank transfer, you need to specify your desired currency and how much you want to deposit. Binance will then provide you with details of the account you need to make the transfer to, alongside the reference number you need to include within the transfer.

KYC is Required for Fiat Deposits and Withdrawals

It is important to remember that Binance will require you to go through a simple KYC process before they can accept your fiat deposit request. This is to ensure that Binance remains compliant with all respective anti-money laundering laws. This is especially crucial for the exchange at a time that they are looking to obtain the necessary regulatory approval to launch an exchange in the US.

To do this, you’ll initially need to enter your full name, home address, country of residence, and date of birth. You will then be redirected to the platform’s third-party verification partner – NetVerify. To complete the KYC process, you’ll need to upload a copy of your government issued ID. This needs to either be a driver’s license, passport, or national ID card.

Security at Binance

Binance offers a number of security safeguards to ensure your funds remain safe from the threat of external malpractice. Firstly – and as we noted earlier in our step-by-step account set-up overview, you are advised to install 2FA. This means that unless a hacker has access to your mobile phone, they won’t be able to gain access to your Binance account.

Moreover, if you attempt to login from a device or IP address that has not previously been used on Binance, you will need to confirm this via your registered email account. You can also choose to receive email notifications when key account functions are performed, such as withdrawals.

While we are on the topic of withdrawals, Binance recently introduced its ‘Address Whitelisting’ feature. Ordinarily, you have the option to withdraw your cryptocurrency funds to any wallet address. However, if you set-up the address whitelisting feature from within your account, you can ensure that withdrawals can only be made to a single address. You can of course amend this at any time, although you’ll need to go through an extra couple of security steps.

SAFU Reserve Fund

We really like the Secure Asset Fund for Users (SAFU) that Binance introduced in 2018. The SAFU function acts like a reserve fund in the event that the platform experiences a hack. The reserve SAFU pot is funded by taking 10% of all trading fees that Binance generates. When you take into account the multi-billion dollar trading volumes that the platform is accustomed to, the fund could potentially grow to a significant amount.

As great as the security features are at Binance, it is important to note that the platform was actually hacked in May 2019. The malicious actors were able to remotely steal surplus of 7,000 Bitcoin, which at the time amounted to a market value of just over $40 million. The good news is that the platform utilized the aforementioned SAFU fund, meaning that Binance customers that were affected did not lose any money.

Regulation

In terms of its regulatory status, Binance is regulated in Malta under its newly enacted Virtual Financial Assets (VFA) act. Other than this, Binance is not licensed by any other regulatory bodies. However, this isn’t to say that the platform does not comply with its anti-money laundering obligations.

On the contrary, Binance requires all customers that plan to use fiat currencies to deposit and withdraw to go through a KYC process. Moreover, if you attempt to withdraw more than 2 BTC in a 24 hour period, then you will also be required to go through a verification process.

It is also important to note that Binance is in the process of applying for regulatory approval in the US to launch a fully licensed exchange for US citizens. This means that it will need to ensure its regulatory endeavours are water-tight if it is to get the green light.

So now that we’ve covered account security and regulation, in the next section of our review we are going to cover customer support.

Customer Support at Binance

When the crypto-craze of late 2017 was in full force, Binance experienced a significant wave of new account applications. The throughput was so high that the platform had to temporarily suspend new registrations. With that being said, Binance has since increased its customer support team by a considerable amount.

If you do need to make contact with somebody at Binance, you can submit a ticket request via your account portal. Alternatively, if you are using Binance Jersey for your fiat currency needs, then you can access a 24/7 live chat facility. Unfortunately, Binance does not operate a telephone support hotline.

The platform does have a good presence on social media though. This includes Telegram and Twitter, so it’s well worth using these channels if you are yet to receive a response.

Binance Margin Trading

The team at Binance recently introduced margin trading to its platform. You will need to apply for a margin account if this is something you’re interested in, which will include a disclaimer form indicating that you understand the risks involved.

You will need to transfer Binance Coins to your maring trading wallet, which is essentially used as collateral against the funds you intend to borrow. Binance will allow you to trade at a margin rate of 3:1, meaning that if you have the Bitcoin equivalent of 1 BTC, you can effectively borrow 2 BTC.

If you are engaged in margin trading and your margin balance falls below 1.3, then Binance will get in touch to let you know that a margin call is required to avoid liquidation. If your margin balance then drops down to 1.1, Binance will be forced to liquidate your trade, meaning you’ll lose your collateral.

As such, you should only trade on margin if you have a firm understanding of the underlying risks.

Binance Review: The Verdict?

In summary, it’s easy to see why Binance is now one of the largest cryptocurrency exchanges in the industry. With customers offered super low trading fees, hundreds of crypto-to-crypto trading pairs to choose from, and enhanced security features – Binance is an excellent choice if you’re looking for a new exchange to join.

In reality, it’s amazing just how quickly the platform has grown since it was launched in 2017. Although the exchange is less than two years old, Binance is already responsible for billions of dollars in weekly trading volumes.

It is also a good move that the platform is now able to facilitate fiat currency deposits and withdrawals. While at the time of writing this is only available in a select number of nation states, it is likely that Binance will continue to roll out it’s credit card and bank transfer facilities over the coming months.