It is often said that cryptocurrencies and blockchain technology will eventually disrupt most industry sectors. Whether that’s traditional money, finance, real estate, or social media – the cryptographic revolution has the potential to change the way we view conventional systems.

With that being said, a somewhat new angle that cryptocurrencies like Bitcoin can revolutionize is that of the consumer loan space. Companies such as Nexo is doing just that via its instant crypto credit line.

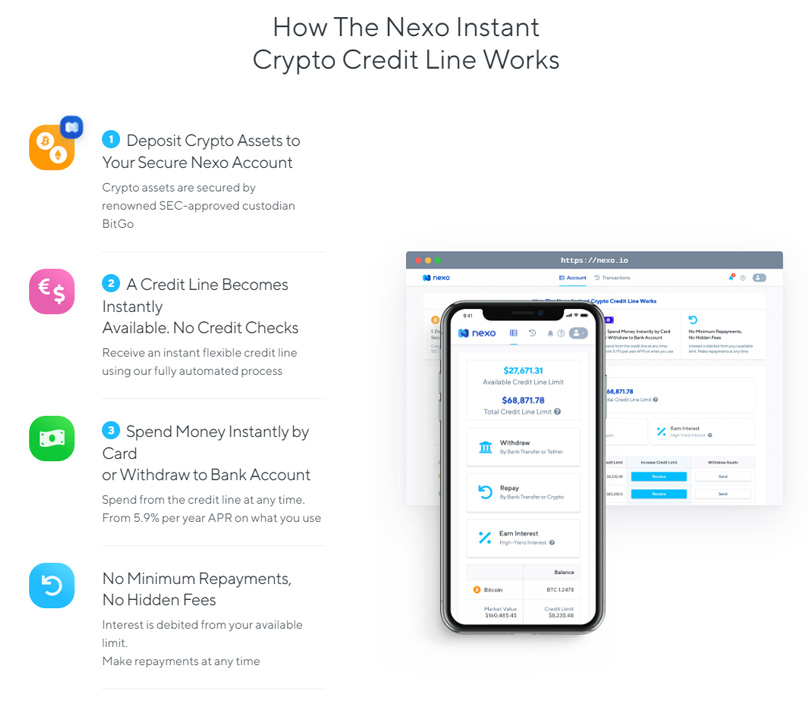

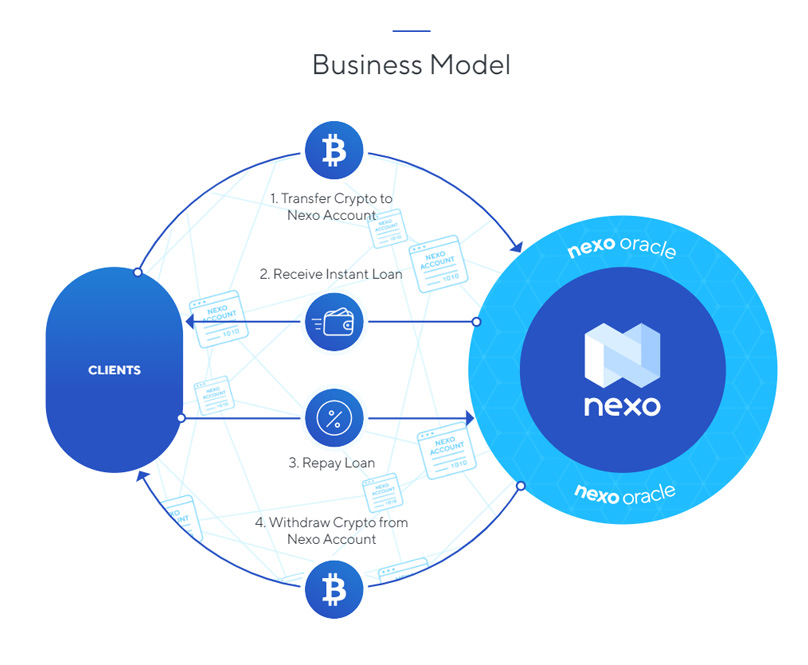

In a nutshell, by depositing cryptocurrencies into a Nexo account, the platform will give you a line of credit. The specific amount will depend on the size of the security deposit you put up, and you can request to receive the money in real-world currencies such as the Euro, US Dollar, or British Pound.

In the need of financing of think that the crypto-based platform might be up your street? If so, be sure to read our Nexo Review first. Within it, we’ll cover the ins and outs of how Nexo works, who is eligible, how much you can borrow, what interest rates you’ll pay, whether your money is safe, and more.

What is Nexo?

Nexo is an online loan platform that allows you to obtain financing in return for putting up a security deposit. With that said, the platform is involved in the cryptocurrency lending market, meaning that your security deposit will come in the form of digital currencies like Bitcoin and Ethereum.

In return, you’ll be able to borrow an amount that is proportionate to the size of your security. Crucially, Nexo allows you to borrow funds in real-world money. Think along the lines of USD, EUR, and GBP.

In fact, at the time of writing the platform supports more than 45 different fiat currencies, illustrating that the platform is targeting a global audience.

When it comes to receiving the loan funds, Nexo offers two options. You can either have the money deposited into your local bank account, or alternatively, obtain the Nexo credit card. If opting for the latter, this allows you to use the funds online, in-store, or at an ATM.

As a loan provider, Nexo will, of course, charge you interest on the borrowed funds. This starts at 5.9% APR per year, although the specific rate will depend on whether or not you are prepared to use its native Nexo token.

As a loan provider, Nexo will, of course, charge you interest on the borrowed funds. This starts at 5.9% APR per year, although the specific rate will depend on whether or not you are prepared to use its native Nexo token.

A further selling point to using the Nexo platform is that you can liquidate your cryptocurrency holdings without needing to sell them.

In other words, as long as you always meet your repayments, you’ll get the exact amount of cryptocurrency back once the loan has been repaid in full. If you’re a true believer of the cryptocurrency revolution, then this allows you to stay in the market while at the same time free up some much-needed cash.

Although instant crypto loans are still a relatively new phenomenon, Nexo is already behind some impressive numbers.

- This includes more than $700 million in financing across 200,000 Nexo users.

- The platform also claims to have received more than $1 billion in crypto loan requests, which indicates that it has a super-high acceptance rate.

How Does Nexo Work?

It might take a bit of time before you fully get your head around how crypto lines of credit work. As such, it might be best to read through the step-by-step process we have outlined below.

Step 1: Assess how Much you can Borrow

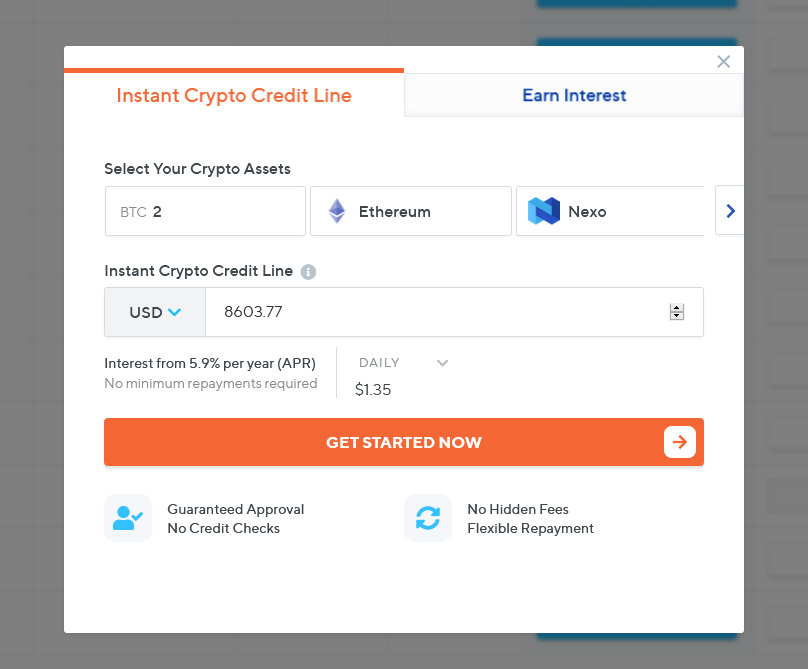

First and foremost, Nexo does not issue loans in the traditional sense, insofar that your credit rating will not be assessed. Moreover, you won’t need to provide any information about your personal finances, such as how much you earn or whether you own a property. Instead, Nexo bases its financing amounts on the size of your security deposit.

In the vast majority of cases, you will be able to able to borrow 50% of the total market value of your security deposit if using Bitcoin or Ethereum.

- For example, let’s say that you are willing to put 2 BTC up as security.

- If the current market value of Bitcoin was $10,000, this amounts to a total holding of $20,000.

- As such, Nexo would allow you to borrow $10,000 against your 2 BTC security deposit.

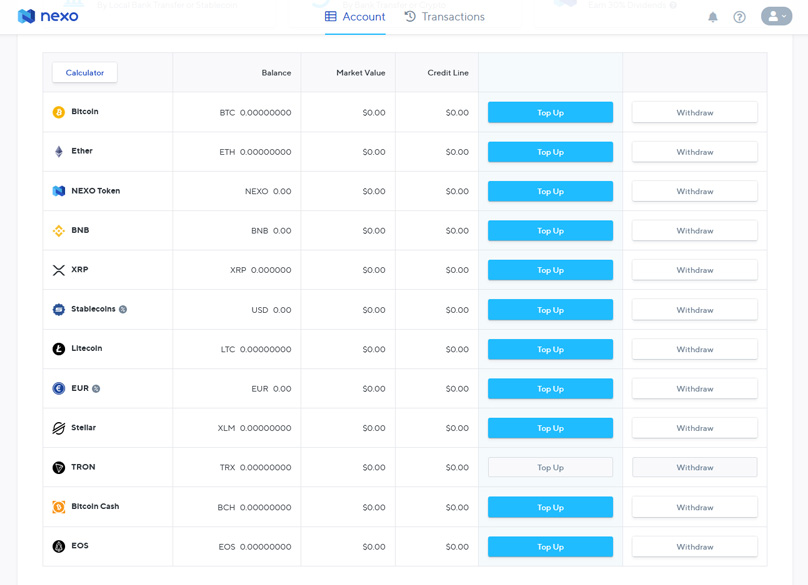

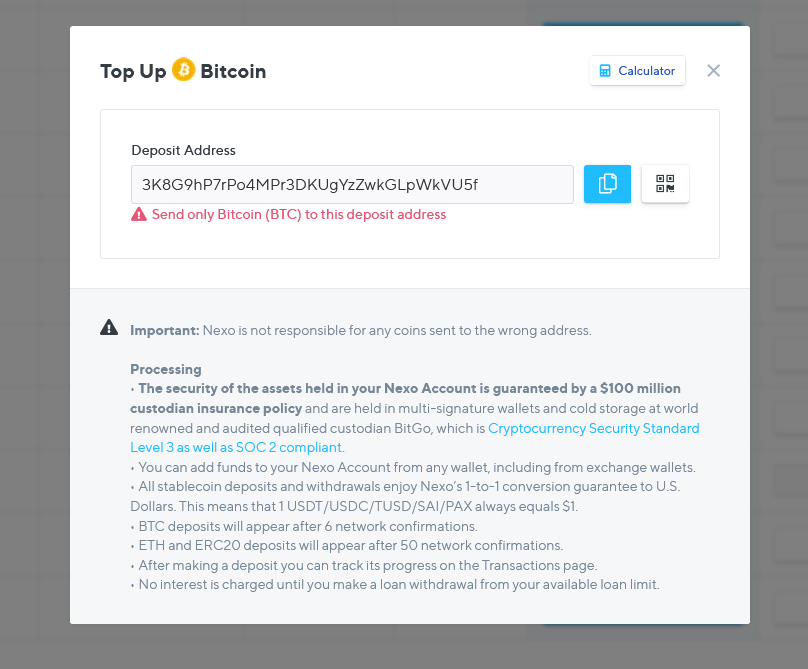

Step 2: Transfer Your Security Deposit to Nexo

If you want to proceed with your financing application, you will then need to transfer your security deposit to Nexo. The process works in exactly the same way as depositing coins into a third-party cryptocurrency exchange.

As such, you’ll first need to head over to the deposit page within your Nexo account.

Once you have clicked on the digital currency that you wish to use as security, you then will be shown your unique deposit address.

Copy the deposit address to your clipboard, and then head over to your private wallet. Paste the Nexo address into your private wallet and transfer the funds over.

As soon as the respective blockchain validates the transaction, the funds will appear in your Nexo account.

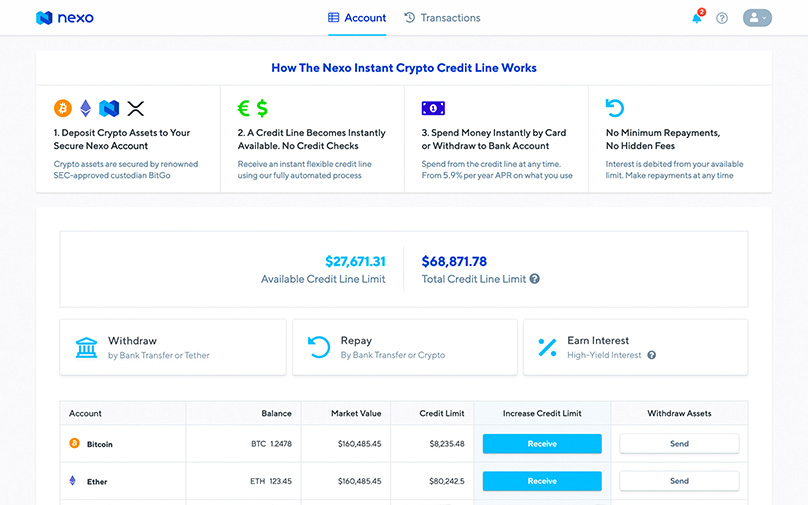

Step 3: Withdraw Your Funds

As soon as your security deposit is added to your Nexo account, you will then be able to view your line of credit. At this stage of the process, you are under no obligation to take the money out. As such, you won’t pay any interest on the funds until a withdrawal is executed.

If you do need access to your line of credit, you can request a withdrawal to your local bank account in fiat money. Crucially, more than 45 currencies are supported. It should take no more than a few days for the funds to arrive, and this will depend on where your bank account is located.

Alternatively, you might want to consider obtaining the Nexo credit card. This allows you to spend your line of credit in the real-world as and when you need to.

Step 4: Making Repayments

Although you have a security deposit held at Nexo, you still need to treat borrowed funds as a financing agreement. As such, you will need to make repayments on the amount that you withdraw from your line of credit. The specific interest rate and minimum repayment amount will be stipulated by Nexo at the time of the loan, albeit, we’ll cover this in more detail later.

Nevertheless, when it does come to meeting your monthly repayments, you don’t necessarily need to do this in the currency you received the funds in. On the contrary, you can choose to pay in USD, EUR, or GBP. You’ll need to do this by making a bank transfer directly to Nexo. Moreover, you can also settle your payments in a supported cryptocurrency.

As and when you do make a payment, you’ll see this reflected in your outstanding balance once it is validated by the team at Nexo.

How Much can I Borrow at Nexo?

Nexo uses a Loan-to-Value (LTV) system when determining how much you can borrow.

This means that the size of your credit line will be based on the amount that you are prepared to put up as a security deposit. However, the specific LTV ratio will also depend on the type of cryptocurrency that you deposit.

Below we have listed the LTV ratios listed by Nexo:

- Bitcoin (BTC) and Ethereum (ETH): 50% LTV

- Ripple (XRP): 40% LTV

- Stablecoins: 90% LTV

- Nexo: 15% LTV

- Binance Coin (BNB), Bitcoin Cash (BCH), and EOS: 30% LTV

- Stellar Lumens (XLM): 17% LTV

Take note, there might come a time when Nexo offers you a slightly lower LTV ratio. This might be because a particular digital currency is going through a period of high volatility, or because the size of the loan is significant.

What Currencies Does Nexo Support?

Nexo is a multi-currency platform that supports both fiat currency and cryptocurrencies.

Security Deposit

When it comes to funding your security deposit, you can put the following coins up as collateral:

- BTC

- ETH

- XRP

- LTC

- XLM

- BCH

- EOS

- Stablecoins

- NEXO

- BNB

Fiat Currencies

When it comes to withdrawing your loan funds in the form of a bank transfer, Nexo supports 45 different fiat currencies. This includes all major currencies such as USD/EUR/AUD/GBP/JPY/CAD/SGD. Heaps of minor/exotic currencies are also supported. This includes RON/PHP/UAH/PKR.

As Nexo is known to add and remove supported fiat currencies, you are best to check the platform to see if you’re preferred currency is supported.

How Much do Nexo Loans Cost?

As is the case with any loan provider operating in the financing market, you will need to pay interest on the money you borrow from Nexo. However, Nexo operates in a completely different manner to traditional lenders, not least because it utilizes just two fixed interest rates.

Ordinarily, a lender would base your APR on a number of variables, such as your creditworthiness and income, as well as the size and duration of the loan. On the contrary, the interest rate applied to your Nexo loan is dependent on whether or not you use the platform’s native token.

For example, if you are able to repay your loan with the Nexo token, you’ll get a fixed rate of 5.9% APR. You’ll also get this rate if part of your loan is backed by the Nexo token.

Alternatively, if none of the two metrics listed above are met, you will pay a fixed rate of 11.9% APR.

What Happens to Your Security Deposit?

If you’ve ever taken out a secured loan in the real world, then you should know that the process is largely the same at Nexo. You will be able to withdraw your security deposit out only when you have repaid the borrowed funds in full.

Until then, your collateral will remain in the hands of Nexo. However, you will still retain full ownership of the asset while your repayments are being made.

Using Nexo to Free-up Capital

Nexo allows you to free-up some much-needed cash without needing to sell your cryptocurrency holdings.

- For example, let’s say that you entered the market when Bitcoin was priced at $13,000.

- Even though Bitcoin is now priced at $8,000, you have absolutely no intention of selling, as you’re in the crypto-space for the long-run.

- However, you also have a desperate need to raise some cash.

In this sense, you have one of two options.

- On the one hand, you can go through the cumbersome process of borrowing money from a conventional lender. Not only will you need to go through a long application process, but you will also have your credit score checked. This in itself can lead to a mark on your FICO report. Moreover, if you’re only looking to borrow the cash on a short-term basis, you’ll likely be hit with a huge APR.

- Your second option is to instead use Nexo. Not only is your application guaranteed to be approved, but you’ll also receive the funds super fast. Moreover, you are only borrowing an amount proportionate to the LTV of your chosen cryptocurrency. Even more importantly – and as we’ll cover in more detail shortly, borrowing money from Nexo will not appear on your credit report.

Receive the Exact Amount of Cryptocurrency Back

Sticking with the example used above, let’s say that you are looking to transfer 1 BTC as a security deposit. To clarify, although you paid $13,000 at the time of the purchase, Bitcoin is currently priced at $8,000. As such, you deposit your 1 BTC into Nexo in return for a $4,000 loan in US Dollars.

When you finally get around to repaying your loan, you will then be able to withdraw your security deposit back out. This is where things get interesting. Let’s say that during the repayment period, Bitcoin went on a prolonged bull run, and it’s now valued at $15,000. As you deposited 1 BTC as security, you will get the same 1 BTC back. However, Bitcoin is now worth more than what it was when you took the Nexo loan out, so you’re also in profit.

The key point that we are making here is that you can use Nexo as a means to stay in the crypto market. In other words, even if you need to raise cash, there is no requirement to sell your cryptocurrency holdings.

Increased Line of Credit

It is also important to note that Nexo will increase your line of credit in the event that your security deposit appreciates in value. You are under no obligation to utilize this additional funding source, although it’s handy to have nonetheless.

Will my Nexo Loan Appear on my Credit Report?

You know the drill – regardless of the type of credit you obtain, loan providers will almost always report the agreement to credit agencies. Even if you are taking out a specialist no-credit-check loan, missed payments and defaults will always be reported.

With that being said, Nexo has no relationship with credit agencies whatsoever. This starts at the very offset with the initial application.

As all loans are issued based on the size of your security deposit, there is no requirement for Nexo to perform a credit check on you. Similarly, Nexo will not report your repayments – even if default.

What Happens if I Don’t Repay my Loan?

It is really important that you take some time to understand this section, as it relates specifically to liquidation.

- Firstly, as long as you meet your repayments, you have nothing to worry about.

- However, if you fail to make repayments and the cryptocurrency you have held as security begins to depreciate in the open market, Nexo will send you a warning.

- This warning will notify you that if a payment isn’t made, and the asset continues to depreciate, they will be forced to sell some of your security deposit to cover the shortfall.

Nexo will do this by exchanging your security deposit for a currency of its choosing via a third-party exchange. This in itself can result in unwanted fees, so it’s best that you avoid having any of your collateral liquidated.

On the contrary – and as noted above, if you fail to make any repayments, but your security deposit appreciates in value, then you shouldn’t have anything to worry about. The reason for this is that the LTV ratio will go in your favour.

However, don’t forget that you still need to pay interest on any outstanding balances. Even if your security continues to rise in value, make sure that your LTV ratio is kept in check. You can do this at any time through your Nexo account.

Are my Funds Safe at Nexo?

The cryptocurrency and blockchain technology space is fraught with scams and scandals, so the safety of your money should always be your main priority.

After all, you will be entrusting Nexo with more than what you actually receive. For example, you will need to deposit twice the amount of Bitcoin in comparison to the amount of fiat currency you receive in loan funds.

With that said, Nexo has a good number of safeguards in place to ensure that your funds are kept safe and secure.

Custodianship and Insurance

First and foremost, all customer funds are held in cold storage by third-party custodian BitGo.

Crucially, this custodian partnership ensures that customer funds are insured in the event that the worst happens, as BitGo is insured by up to $100 million with Lloyd’s of London.

As per Nexo itself, the custodian agreement would kick-in if the platform was hacked, funds were stolen by a company employee, or private keys were lost.

Know Your Customer (KYC)

Nexo also complies with all relevant laws surrounding anti-money laundering and terrorist financing. This means that regardless of where you are based, you will need to verify your identity. Nexo uses a third-party FinTech company for the KYC process.

All you need to do is upload a high-quality image of your government-issued ID, such as a passport or driver’s license. The KYC process is automated, so you should be able to verify your account automatically.

Account Security

In terms of keeping your Nexo account safe, you will have the option of setting up two-factor authentication (2FA). This ensures that account access is only granted when a unique code is confirmed on your mobile device.

You can either elect to receive an SMS message, or install an app like Authy. Although 2FA isn’t compulsory at Nexo, we would strongly advise you to enable it.

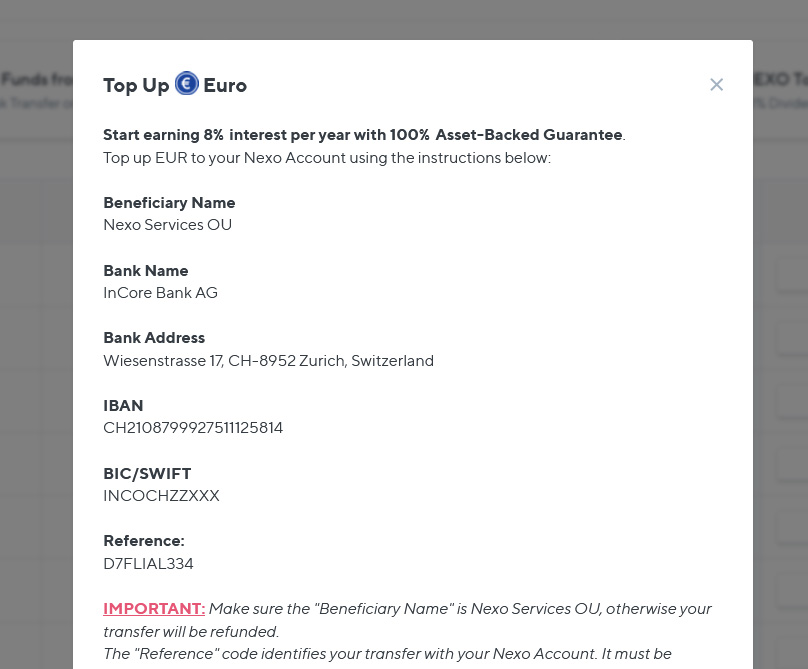

Earning Interest at Nexo

Although crypto lines of credit form the core of Nexo’s business model, the platform also allows you to earn interest.

- In a nutshell, by depositing Euros into your Nexo account, you will earn 8% interest per year.

- The interest is paid out daily, so this allows you to enjoy the fruits of compound interest.

The most attractive part of this offering is that you can withdraw your funds at any given time. This is somewhat unusual, as alternative investment platforms typically require you to lock your money away for longer periods of time.

In terms of safety, your Euro deposits are backed by overcollateralized loans. Each of these loans are protected by the $100 million Lloyd’s of London insurance safeguard that we discussed earlier.

Nexo Credit Card

If you’re looking to spend your crypto holdings in the real world, it might be worth considering the Nexo credit card. Backed by MasterCard, you will be able to use the card online, in-store, or to withdraw money from an ATM. Your credit limit will be based on the line of credit you have at Nexo.

The card comes with a fully-fledged mobile app, which allows you to freeze the card in the event that its lost or stolen, monitor transactions, and change your PIN. The Nexo card also offers 5% cashback every time you purchase something. The cashback is subsequently added to your Nexo wallet once the transaction is settled.

The Nexo credit card does not come with any account or inactivity fees, nor will you pay anything when making point-of-sale payments. Moreover, the card offers fee-free foreign exchange purchases, so it could come in handy when travelling overseas.

Nexo is Tax Efficient

Nexo helps solve a tax problem with Cryptocurrency: If you sell your crypto assets, if they have risen in price since you purchased them you will be liable for Capital Gains tax ( either short-term or long-term depending on how long you have held them. ) This makes an expensive solution if you are looking for money in the short-term.

By using Nexo, you can avoid any Capital Gains issues as you have not sold the asset, merely borrowed against it’s value.

This is the situation as it currently stands for countries like the USA and the UK but Nexo operates in over 200 countries worldwide so make sure to check your relevant tax authorities to make sure.

Conclusion

Nexo is an innovative product which takes advantage of decentralization and the increased ownership of cryptocurrencies.

The platform is easy to use and well designed, if you are familiar with purchasing and transferring cryptocurrency you will have no problem using it all.

They are widely regarded in the industry and one of the pioneers in this emerging space.

Having said that, they are still new in the scheme of things and are not regulated by relevant authorities around the world in the same way that banks and other lenders are – this is something you should be aware of.

It should also be noted that Cryptocurrency is a highly volatile industry, there can be wild swings in price from day to day. As such, this could mean that you get “margin called” and Nexo has to sell some of your cryptocurrency deposit to cover any shortfalls in price.