Crowdestate Review: real estate crowdfunding platform, Fancy incomes a few passive earnings from the multi-trillion greenback actual property business? Ordinarily, you’d be required to buy a property outright.

This means you’ll both have to have a severely giant amount of money on the prepared or decide on a super-long mortgage settlement. At Crowdestate Review can know about it.

With that being mentioned, real estate crowdfunding platforms akin to Crowdestate mean you can acquire publicity to actual property initiatives from simply €100 per funding.

Real Estate Crowdfunding Platform

The platform gives a spread of real estate funding alternatives that primarily facilities on mission developments and mortgage financing.

The entire offers facilitated by Crowdestate are pre-vetted by the platform’s due diligence crew, and so they all yield common money movement funds.

As such, Crowdestate is a notable possibility in the event you’re seeking to earn passive earnings.

In case you suppose the platform is appropriate for your long-term investment objectives, then remember to learn our in-depth Crowdestate Review.

We’ll cowl the ins and outs of how the crowdfunding website works, who’s eligible, how a lot you can also make, and whether or not or not your cash is protected.

Crowdestate Review: At A Glance

Crowdestate Review Detail

- Name: Crowdestate

- Website: https://Crowdestate.com

- Special Offer: Get Free Instant Access Here

- Owners: Crowdestate

- Overall Rating: 3.8/5 [Trustpilot]

- Summary: Product Sort P2P Crowdfunding in Actual Property Potential Return17% Charges No Charges Min Funding €100 Property Sorts Industrial & Residential in Europe.

- Crowestate Scam or Legit: It’s totally legit.

- Who it’s for: Everyone.

Crowdestate Review: What’s Crowdestate?

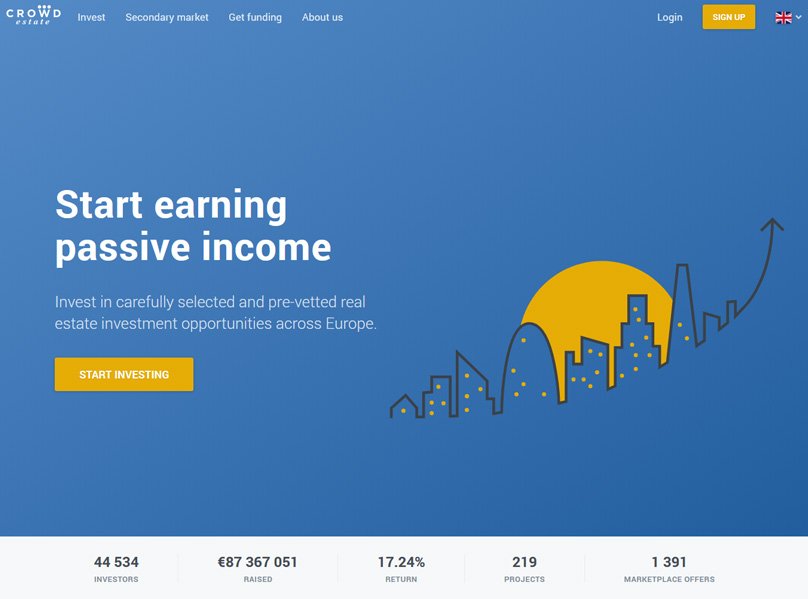

Launched in 2014, Crowdestate is a web-based crowdfunding platform that enables on a regular basis traders to realize publicity to the European actual property area.

Based mostly in Estonia, the platform claims to have returned traders a mean annual yield of 17.26% since its inception. This covers greater than 43,000 lively members throughout 117 nations.

Apparently, the variety of funding alternatives hosted by Crowdestate is considerably skinny on the bottom compared to its market rivals. The truth is, the platform has facilitated simply 214 funding alternatives since 2014, with Crowdestate noting that 95% of candidates fail to make it to the funding stage.

We like this because it illustrates that the due diligence crew is super-picky concerning the debtors they cope with.

When it comes to the sorts of actual property alternatives that you simply be capable to spend money on, Crowdestate sometimes focuses on financing. This might be to assist finance an actual property developer that needs to construct a property advanced or a development firm that wants an enterprise mortgage to develop a brand new grocery store.

In both approaches, the entire loans that you simply spend money on can be secured by bodily actual property and/or the underlying land plot.

Whereas this does provide a component of safety in your investments, Crowdestate nonetheless comes with its dangers. In any case, with the typical annual yield of 17.26%, the ‘threat vs reward ratio is in direction of the higher finish of the dimensions.

As such, had been the end-borrower to default on their mortgage, you stand the very actual threat of shedding the entire cash that you simply injected into that specific deal.

Many of the funding alternatives hosted by the platform could have a hard and fast time period of between 1-4 years. Though you’ll ordinarily want to attend till the loans mature, Crowdestate does have a secondary market.

This provides you with the prospect of offloading your investments to different members of the platform, ought you could liquidate a few of your holdings.

Eligibility at Crowdestate

Though Crowdestate focuses fully on actual property funding alternatives in Europe, the platform gives its providers globally. Nonetheless, not all nation-states are eligible.

Notably, this excludes residents of the US. As such, we might recommend checking to see in case your nation is supported earlier than going any additional.

Aside from your nation of residence, you could guarantee that you’re at the very least 18 years of age and that you’ll be able to execute a world financial institution switch. This may be by way of SEPA or SWIFT.

What Will I be Investing in at Crowdestate?

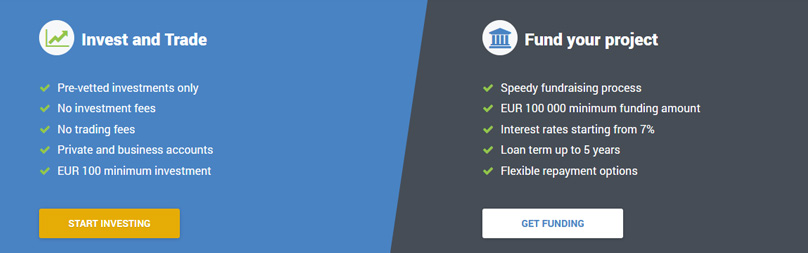

Crowdestate gives plenty of completely different funding sorts on its platforms – all of that are pre-vetted by the due diligence crew. As famous earlier, simply 5% of financing purposes make it to the platform for funding.

It is very important to notice that Crowdestate doesn’t spend money on properties per se. As an alternative, it sometimes facilitates loans for actual property firms that want to boost finance.

Let’s check out a couple of funding examples so that you’ve got an agency grasp of the place your cash is prone to find yourself at Crowdestate.

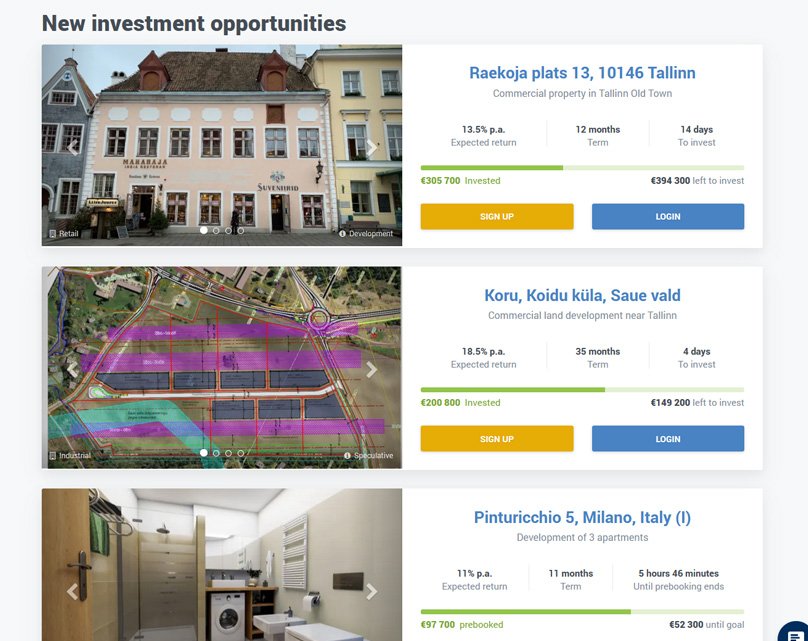

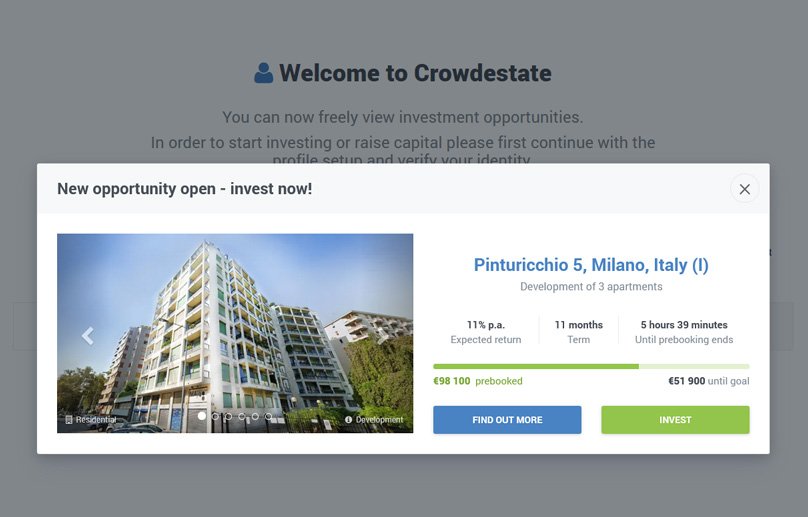

Instance 1: Mortgage secured row home growth mission

A funding alternative that lately achieved 100% funding on the platform is that of a terraced home mission. In a nutshell, the mission builders had been seeking to elevate €400,000 to finish the development of three small condominium blocks. Situated within the Estonian metropolis of Viimsi, the mission will yield 4 separate flats throughout every block.

Upon additional exploration, the event was 45% accomplished by the point it made the Crowdestate platform, with 4 of the 12 flats already bought.

Funding like this gives a spread of safeguards in your funding, not least as a result of you have got the bodily flats securing the mortgage. When it comes to the basics, Crowdestate traders engaged in an 11-month time period, with an anticipated charge of return of 11% per yr. This was broken up throughout 719 particular person members of the positioning.

Instance 2: Buy, renovation, and resale a giant condominium

An extra alternative that additionally acquired 100% of its goal funding quantity is that of buying, renovating, and resale a giant condominium. Situated within the Italian metropolis of Novara, the top borrower required €80,000 to assist with the prices of buying the condominium after which refurbishing it on the market. Crowdestate notes that the condominium already has curiosity from potential consumers, though this can’t be verified.

Nonetheless, as soon as the 100 m2 condominium has been absolutely renovated, it should then be listed on the market. As soon as once more, your funding comes with sure safeguards, not least as a result of the condominium has been used as collateral to save the mortgage.

When it comes to the basics, the €80,000 was coated by 599 Crowdestate members, and the time period of the mortgage is 7 months. Traders will obtain an anticipated charge of return of 12.15% as soon as the funds are repaid in full.

Instance 3: 220 flats in Bucharest

One of the bold funding alternatives that we got here throughout at Crowdestate was that of a condominium advanced in Bucharest. The mission requires €1.1 million in funding and has up to now raised €890,000. Firstly, a few of the funds can be used to buy the respective land plots. Subsequently, the end-borrower will fund the event of 220 flats.

Crowdestate doesn’t state how long the development section will absorb whole, though the time period of the mortgage for these investments is simply 11 months. The chance will yield an anticipated charge of return of 15.77% yearly, and 1,323 Crowdestate members have up to now backed the deal.

When it comes to the dangers, the funding is backed by the underlying land that the developer purchases. Whether or not or not this can be adequate to cowl the results of a possible default stay to be seen, though that is absolutely mirrored within the excessive yield on providing

How A lot Can I Make at Crowdestate?

There isn’t a one-size-fits-all reply to how a lot you’ll make by investing at Crowdestate, not least as a result every alternative comes with its personal yield. With that being mentioned, let’s check out a few of the averages.

Crowdestate itself notes that for the reason of the platform’s inception, traders have netted an annual return charge of 17.26%. That is considerably greater than the sorts of yields out there in conventional asset lessons, akin to the S&P 500. Nonetheless, as are the dangers.

After we explored the funding alternatives out there for funding at the time of writing, these sometimes begin at 11% per yr, as much as a most of 17% for higher-risk offers.

Crucially, the particular curiosity on provide will depend upon plenty of elements. This contains the creditworthiness of the developer, how a lot they want to borrow, and for the way lengthy.

Moreover, the rate of interest may also be depending on the underlying safety. For instance, if the mission is backed by bricks and mortar that’s appropriate for resale on the time of the funding, the yield can be decreased. Quite the opposite, if the collateral is predicated on bought land, the yield can be greater.

Crowdestate Charges

Crowdestate doesn’t cost any charges to open an account, nor will you could pay an annual membership price of any type. Furthermore, there aren’t any charges related to funding your account. In even higher information, Crowdfunding doesn’t deduct any charges from the yields listed on its funding alternatives.

As such, a chance that yields 11% can pay 11% so long as the end-borrower meets their obligations in full.

Crowdestate makes its cash by taking a minimum of what it prices builders to borrow funds from its platform. It does so by taking 20% of the whole lot over 8%. This fee is just taken if the borrower pays the mortgage again in full.

Furthermore, this doesn’t impression the yield that you’re provided at the time of the funding, so in impact, Crowdestate is a fee-free platform for traders.

When do I get my Cash Again?

At first, every funding alternative comes with a hard and fast time period that sometimes averages 1-4 years. As soon as the chance meets its 100% funding purpose, the cash will then be transferred to the end-borrower. The financing settlement will then function like some other mortgage sort, insofar that the borrower can be required to make fastened funds each month.

As soon as cost has been acquired by Crowdestate, it should then distribute the cost to people who maintain funding in that specific construction. The particular quantity can be proportionate to the dimensions of your funding.

Every month-to-month cost will embrace curiosity, so all being nice, you’ll obtain your whole funding again plus the acknowledged annualized return on the finish of the time period. This additionally lets you reinvest your month-to-month funds and thus – benefit from the fruits of compound interest.

Can I Exit a Funding Early?

One of the necessary elements that you could think about when investing at a crowdfunding platform like Crowdestate is that of liquidity. In a nutshell, the platform doesn’t mean you can exit your funding early, that means that you will want to attend till the financing settlement matures earlier than receiving your reimbursement in full.

This might be a difficulty if you could elevate capital rapidly. In case you suppose that there’s a probability that you simply would possibly want to dump your Crowdestate investments early, you could be higher fitted to more liquid asset lessons like shares and shares.

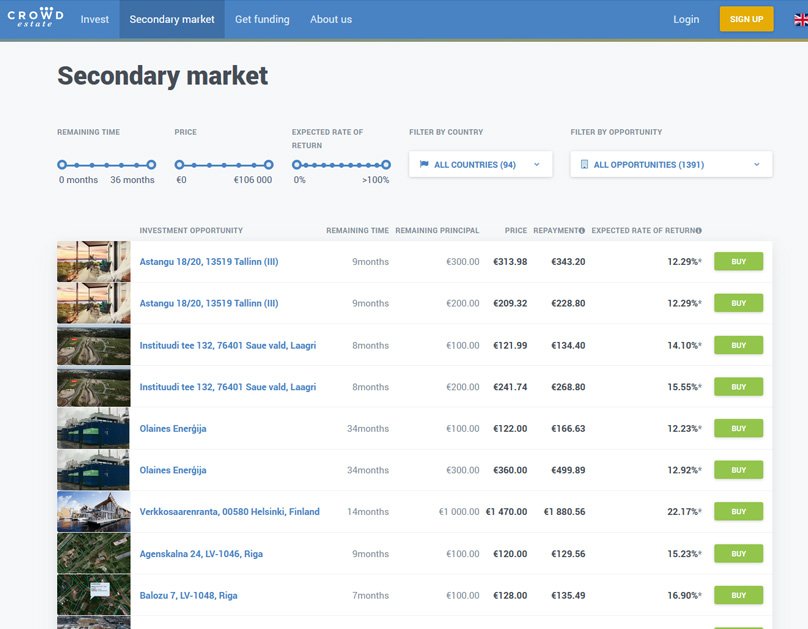

Secondary Market

With that being mentioned, Crowdestate does provide a secondary market. This provides you the chance to promote your excellent investments to different members of the positioning. Take notice, there isn’t any assurance that you’ll discover a purchaser, so by no means make the error of pondering that you simply all the time be capable to offload your holdings with ease.

Nonetheless, there’s a good purpose to consider that the secondary market is liquid sufficient to seek out consumers for 2 key causes.

- Firstly, as Crowdestate may be very selective with the variety of funding alternatives that it lists on its platforms, the overwhelming majority of listings won’t solely attain their full funding goal, however, they sometimes achieve this in a short time. This means except you act quickly on a brand new itemizing, you’ll probably miss out. Because of this, traders at Crowdestate are sometimes required to make use of the secondary market with the purpose to get a glance in.

- Secondly, having explored the secondary market in nice depth, the overwhelming majority of listings are being bought at a slight premium. Though this premium isn’t greater than a % greater than the present funding worth, this means that traders usually are not pressured to promote their holdings at a reduction.

As soon as once more, though the above elements won’t assure that you simply all the time discover a purchaser, you do stand an affordable probability of doing so.

What are the Dangers of Investing with Crowdestate?

In case you’re a seasoned actual property crowdfunding investor, you know firsthand that yields of 11%-17% don’t come without its dangers. The truth is, the dangers are considerably greater than what you’d count on to see within the conventional shares and shares area.

Defaults

The overarching threat that you could be made conscious of is that of default. In different phrases, if the end-borrower runs into monetary difficulties and they aren’t capable of purchasing extra funding, they may not be capable to meet their mortgage obligations.

This might have an extremely detrimental impact on your means to recoup your authentic funding, not to mention the agreed curiosity.

Secured Loans

On the flip facet, all loans at Crowdestate are secured, which means that builders are required to place up collateral earlier than funding is offered. Nonetheless, this doesn’t scale back the dangers of an all-out loss. For instance, if the developer places the underlying land plot up as safety, there isn’t any assurance that this can cowl all the mortgage quantity at public sale.

Furthermore, the restoration course is fraught with charges, so this can as soon as once more scale back the quantity that you’ll be entitled to if a seizure is profitable.

No Buyback Assure

Crucially, not like different crowdfunding platforms lively within the online area, Crowdestate doesn’t provide a buyback assure. This might in any other case place an enormous safeguard in your investments, not least as a result of the mortgage originator will cowl particular person defaults. Nonetheless, the explanation that this isn’t out there at Crowdestate is probably going because of the sheer measurement of the loans facilitated.

Platform Chapter

You additionally want to think about the dangers of Crowdestate itself going out of enterprise. The excellent news is that your investments are stored separately from the corporate’s steadiness sheet.

In different phrases, as your investments are held on a selected nominee account, they’re legally separated from Crowdestate. It’s because each funding is legally held as an SPV (Particular Goal Car).

How do I get Began at Crowdestate?

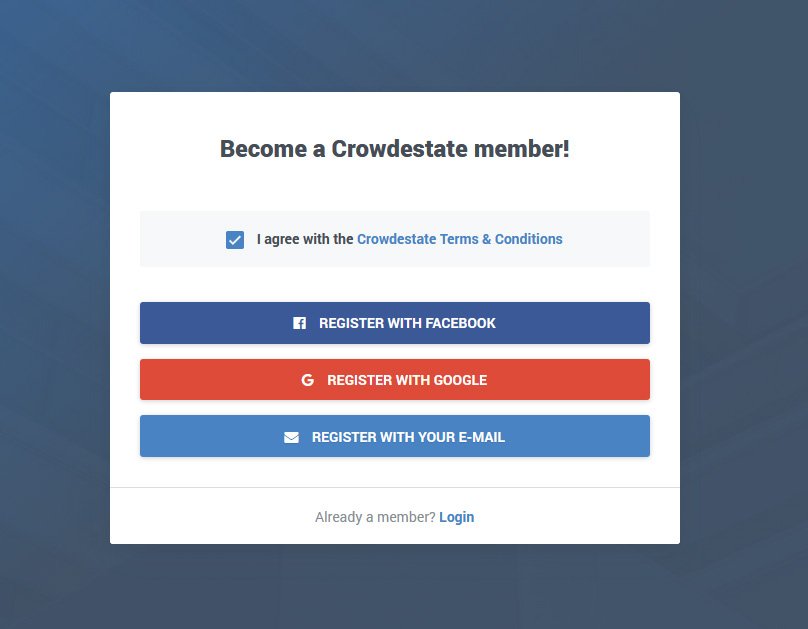

Just like the sound of what Crowdestate gives on your long-term investment objectives? Take a look at the quickfire step-by-step outlined beneath to get began at this time.

Step 1: Open an Account

You’ll first want to move over to the Crowdestate homepage and click on on the ‘SIGN UP’ button, which you’ll discover on the prime right-hand facet of the web page.

You’ll then want to offer some private info. This may embrace your full identity, residence handle, nationality, date of start, and tax standing.

Step 2: Browse Accessible Investments

It’s best to then spend a while shopping by means of the various funding alternatives out there at Crowdestate. Don’t neglect, most alternatives will obtain their full funding goal pretty rapidly. With that mentioned, don’t rush into funding till you might be 100% assured that it’s best for you.

Step 3: Deposit Funds

After you have discovered funding that you simply just like the look of, you’ll then have to fund your Crowdestate account. The minimal funding quantity is €100 so that you’ll have to deposit at the very least this. Moreover, investments are made in increments of €100 thereon, so do bear this in thoughts.

Deposits should be made by way of a financial institution switch, which might both be by means of SEPA (EU account holders) or SWIFT (the UK and non-EU members). You’ll discover the particular financial institution particulars inside your Crowdestate account. Most significantly ─ you could embrace your distinctive Crowdestate reference quantity when making the switch.

Step 4: Buy Your Chosen Funding

When your checking account switch has been credited, you may then proceed to make funding. The itemizing will stay lively at Crowdestate till it reaches its full funding goal. As soon as it does, the funds will then be distributed to the developer in query.

You possibly can then sit again and wait on your repayments to be credited into your account, as and when the borrower does so.

Conclusion Crowdestate Review

In abstract, Crowdestate Review Real Estate Crowdfunding Platform is rightly considered a number one actual property crowdfunding platform.

Whereas the dangers of investing at Crowdestate shouldn’t be understated, we actually like how selective the crew is with the alternatives it lists.

Crucially, simply 5% of mortgage candidates truly make it onto the platform. As such, funding alternatives sometimes promote out pretty rapidly.

We additionally just like the extremely liquid secondary market that’s out there at Crowdestate. That is nice you probably have a necessity to dump investments rapidly.

All in all, with a mean annual yield of 17.26% since its inception in 2014, Crowdestate is nicely price to contemplate on your long-term investment objectives.

Now I hope this Crowdestate Review Real Estate Crowdfunding Platform article can make you a good choice to invest in real estate. please give a comment good luck.

Crowdestate Review: Verdict

Crowdestate

![Crowdestate Review [logo]](https://startentrepreneureonline.com/wp-content/uploads/2021/09/Crowdestate-Review-2021-Pre-Vetted-Real-Estate-Crowdfunding-Platform.gif)

P2P Crowdfunding in Actual Property

Pros

Easy to use

Good price

Sturdy build and ergonomics

Nice Return On Provide

Pre-Vetted Investments

Secondary Market Accessible

Default Charge Is 0%

Auto-Investing Choice

Cons

No Buyback Assure

Not Out There To US Residents

Discover more from Start Entrepreneur Online

Subscribe to get the latest posts sent to your email.

If you have financial difficulties, you can borrow money from getfastcashus – this is the most effective solution. You can apply online anytime. We provide 24*7 solutions on Getfastcashus.

thank you for your information. enjoy your weekend