The path to a full-time role in the high-stakes world of investment banking is almost universally paved with a successful internship. This 10-week audition is more than just a summer job; it is a grueling, high-pressure interview that can launch a stellar career. For students aiming for the top, understanding how to navigate this process is paramount. This comprehensive investment banking internship guide is designed to be your roadmap, from the initial application to converting the experience into a full-time return offer.

The Foundation: Pre-Application Preparation

Long before you hit “submit” on your application, the real work begins. Top banks recruit from a limited pool of target schools, but even non-target students can break in with meticulous preparation.

Academic Excellence: A high GPA (typically 3.5 and above) is a non-negotiable filter. It demonstrates your intellectual rigor and work ethic.

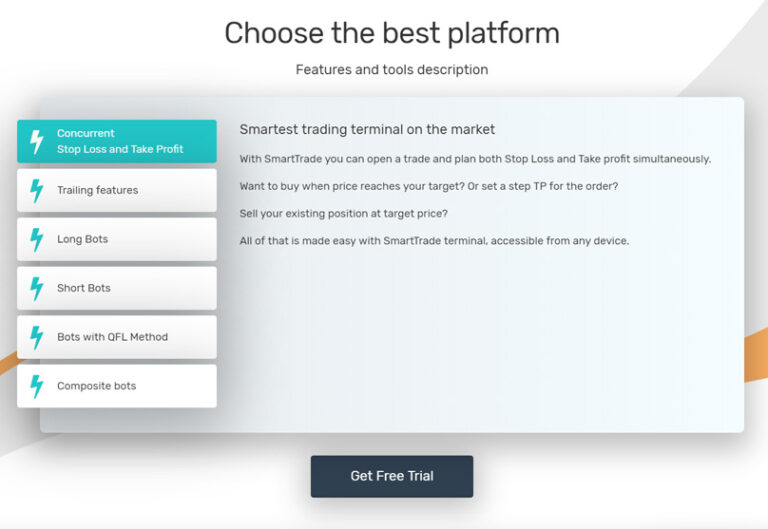

Technical Proficiency: You must be able to talk the talk. This means having a solid grasp of financial accounting, corporate valuation methods (DCF, Comparable Companies, Precedent Transactions), and financial modeling. Start early with self-study, online courses, or specialized training platforms.

Building Your Resume: Your resume must be a single-page, error-free document that screams “finance.” Highlight relevant coursework, any finance-related projects (e.g., a DCF model you built for a class), and leadership experiences. Quantify your achievements wherever possible.

Conquering the Investment Banking Interview

The interview process is a multi-stage gauntlet designed to test your technical knowledge, mental fortitude, and cultural fit. It is here that many candidates stumble.

Technical Questions: Be prepared to be grilled. You will be asked to walk through the three financial statements, explain how a $10 depreciation charge flows through the income statement, balance sheet, and cash flow statement, and elaborate on the nuances of an LBO model. Your answers must be crisp, accurate, and confident.

Behavioral Questions: “Tell me about a time you failed,” “Why investment banking?”, and “Why our bank?” are staples. Structure your answers using the STAR (Situation, Task, Action, Result) method. Your stories should demonstrate resilience, teamwork, a tireless work ethic, and a genuine passion for finance.

Market Awareness: You must be able to discuss recent M&A deals, IPO market trends, and the current macroeconomic environment. Be prepared to pitch a stock or discuss a company you believe is an attractive acquisition target.

Navigating this complex interview landscape requires more than just textbook knowledge. It demands insight, practice, and a strategic approach. For in-depth resources, including common questions and tailored preparation strategies, a valuable resource can be found on The Thinksters‘ page dedicated to investment banking, which covers essential interview techniques and preparation tips.

The Internship Itself: Thriving, Not Just Surviving

You’ve secured the internship. Congratulations! Now the real test begins. The goal is simple: earn a return offer.

The First Day and Week: Be the first one in and the last one out. Soak up everything. Remember names, volunteer for every task (no matter how menial), and constantly ask for feedback. A perfect technical model is useless if it’s delivered with a bad attitude.

Mastering the Work: The work will be tedious—endless Excel formatting, printing pitchbooks, and updating comps. The key is to execute flawlessly. Double-check, no, triple-check your work for errors. When you complete a task, don’t just say “I’m done.” Ask, “What can I help with next?”

Networking and Relationships: Your performance is not just judged by the Associates and VPs you directly work for. Make an effort to have coffee with Analysts, Associates, and even other interns. The Analysts, in particular, can be your most valuable allies and provide crucial feedback to senior bankers.

Maintaining Stamina: The hours will be long, often stretching past midnight and into weekends. Maintain your physical and mental health. Eat properly, get some form of exercise, and ensure you get at least a few hours of sleep. Burnout is a real threat.

Converting the Internship into a Full-Time Offer

As the internship winds down, the evaluation process begins. The formal review is often just a summary of the feedback collected about you over the entire summer.

Seek Continuous Feedback: Don’t wait for the final review. Regularly ask the Analysts and Associates you work with, “Is there anything I could be doing better?” This shows humility and a commitment to self-improvement.

The Final Presentation: Many internships culminate in a group or individual project presentation to senior bankers. This is your chance to shine. Practice relentlessly, anticipate tough questions, and present with confidence and poise. Treat it as if you are advising a real client.

Express Your Interest: In your final meetings with senior bankers, be explicit. Tell them you have loved your experience, that you can see yourself at the firm long-term, and that you are eager to receive a return offer.

Securing an investment banking internship is a monumental achievement, but it is only the first step. By combining impeccable technical skills, a proactive and positive attitude, and relentless effort, you can navigate this challenging journey successfully. Remember, the internship is not just an evaluation of your skills, but a test of your desire to be part of one of the most demanding and rewarding professions in the world.

Discover more from Start Entrepreneur Online

Subscribe to get the latest posts sent to your email.