The Malaysian lending startup ecosystem has expanded rapidly in recent years with the help of private investments and technical support from incubators and accelerators. In January 2022 alone, Indian startups snagged record investments of US$226 million with approximately US$99 million of that going into early-stage funding. It is encouraging to see big local players such as Sunway Group, Petronas, Axiata and AirAsia being active investors in the startup space.

The government is also doing its part in the advancement of Malaysia. In 2016, it created a flagship to enable the entrepreneurial environment through the Fintech Startup Malaysia initiative. As Malaysia pushes towards a more digital economy, the government is working to deploy ICT infrastructure and provide policy support to spur economic growth.

Despite Malaysia’s progress, these startup businesses still face enormous challenges. These challenges include the unorganized and fragmented nature of the market and a lack of transparency regarding policy initiatives that startups can tap into. Lastly, there’s a lack of infrastructure, knowledge, and exposure for those doing business.

Malaysia needs to create more awareness of government initiatives and incentives to help these startups and small businesses. They also need to develop a means of credit disbursement, at least to the priority sectors.

With all the opportunities and challenges out there, it’s important for new lending startups to look at companies that have succeeded and what they can learn from them. Luckily, there are a few companies that Malaysia lending startups can utilize to scale their operations and business outcome. Take a look at these four disruptive and innovative companies below.

LENDI

Lendi is an Australia-based company that aims to make it easier for people to search, choose and settle on a home loan online.

Their smart technology searches for products from over 25 lenders to find clients the right home loan for their specific needs. Their team of Home Loan Specialists then does all the work for their clients, from application to settlement. They’re also on hand to guide clients through the home loan process and answer all questions along the way.

In addition to home loans, Lendi also supplies construction loans, debt consolidation, lender’s mortgage insurance, and offset accounts. Lendi offers its clients transparency and refuses to obtain sponsorship to promote any product, bank, or lender over another. Their lending panel comprises more than 25 banks and lenders, offering over 2,500 products.

HABITO

Habito is a United Kingdom-based company that helps clients find a mortgage, switch a mortgage, and sort any legal work required to obtain a mortgage.

Its mission is to help people find a home. They believe that buying a home and sorting a mortgage is disempowering and confusing for far too many people. They give people the tools, knowledge, and expert support needed to help them buy and finance their homes.

Their experts will search more than 20,000 mortgages from 90 lenders in the market to find the fastest, most effortless mortgage or remortgage ever. They also handle all the buying admin from property survey and legal work to the mortgage itself.

They brand themselves as UK’s only fixed-for-life mortgage company guaranteeing that their clients’ monthly prices will remain the same forever, so clients never have to worry about rates going up. And there’s no exit fee so that clients can leave anytime.

TOMO

Tomo is a United States-based company that prides itself on great rates, fantastic pre-approval, and a fast close. Hello Tomo is doing what big banks and mortgage brokerages have never been able to do—transforming home buying into a customer-centric, streamlined experience.

One that recognizes the individual, uses technology to save time and money, and brings together great mortgages and the most talented real estate agents in the industry.

Hello Tomo can offer such great rates because they don’t charge lender fees. They also have a Tomo Price Match where clients can give them a comparable loan estimate doc, and if it’s valid, they are committed to matching the better deal.

With Hello Tomo, whatever location you are buying in, they pair you with a loan advisor who knows your market and offers communication that works best for you, whether that be text, email, phone, or chat.

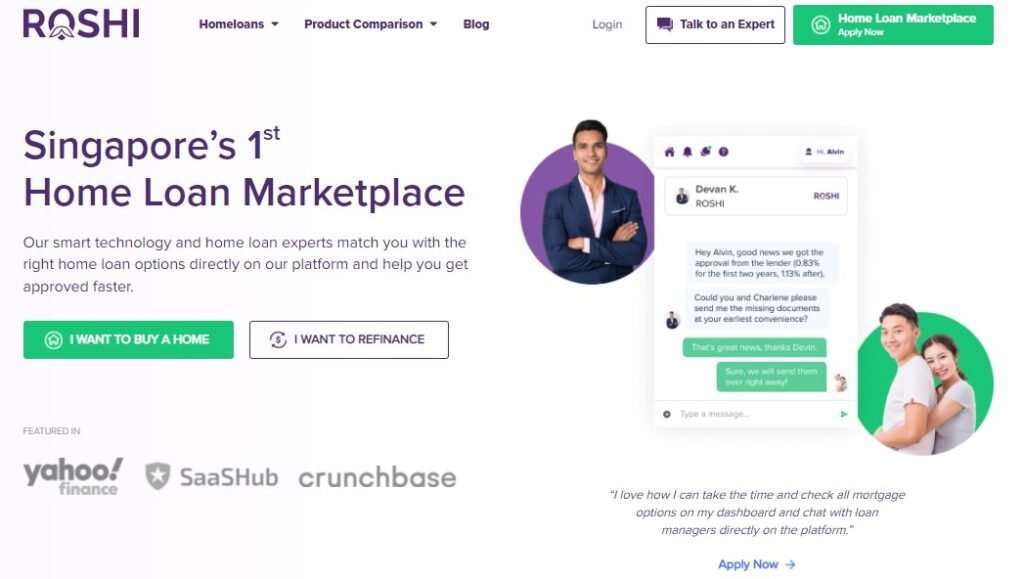

ROSHI

ROSHI is Singapore’s number one home loan marketplace. Their company is on a mission to make the loan buying journey easier than ever with a fully-personalized digital solution and convenience. There’s no need to run from bank to bank.

Their application allows borrowers to set up and access their borrower dashboard, receive personalized loan options and chat with loan specialists directly on their platform.

Instead of allowing clients to break their backs going from bank to bank, ROSHI sources bespoke lender mortgage solutions directly on their platform. Clients can also compare customized loan options and chat directly with loan managers to find the best rates in the market.

They also equipped their platform with machine learning capabilities to auto-approve or reject applications, provide pre-approved loan options, and an auto-messaging to decrease human input and increase scale.

Startups are becoming the champions of India’s growth story, driving economic and social growth through thousands of direct and indirect jobs being created. With all of the growth seen over the past few years, it’s safe to say that India’s market is competitive, but there’s still much room for growth.

Indian Lending Startups seeking guidance now have the opportunity to look to successful companies like Tomo, Habito or ROSHI and utilize their technologies to scale their operations and business outcomes in the lending space.