What Is Yield Farming In Decentralized Finance Defi – Bolstered by its stablecoin liquidity, the platform has grown in popularity with farmers staking throughout the many Curve pools, like Compound, PAX and extra.

Compound pioneered liquidity mining with the launch of COMP in May 2020, and it helped the house explode. Ethereum’s money legos present a way to earn passive income by placing a crypto property to work within the application’s good contracts.

- It’s a useful index to measure the well being of the DeFi and yield farming market as a whole.

- This guide will explain everything you should know about taxes on crypto trading and earnings.

- These pools comprise digital funds that facilitate users to purchase, promote, borrow, lend, and swap tokens.

- Allows lending and borrowing of numerous Cryptocurrencies with rates of interest adjusted to present market circumstances.

- Yield farming protocols may be vulnerable to hacks and fraud due to systemic vulnerabilities within sensible contracts.

This might create unrealised features or losses, and it could lead to you being better off should you had stored your coins available to trade.

The boom within the apply of yield farming may be attributed to the launch of the COMP token, a governance token of the Compound Finance ecosystem. Governance tokens permit holders to take part in the governance of a DeFi protocol.

Next up is yearn.finance, which works to move users’ funds between completely different lending and liquidity protocols to get the most effective interest rates.

Over the course of 2020, an insane sum of money has been made through the Ethereum community as a outcome of yield farming platforms are constructed on Ethereum.

The explosion of popularity reveals the extent to which the monetary revolution promised by DeFi is relying on Ethereum—a comparatively new community.

Client Accuses Bitcoin, Ethereum Backer Three Arrows Capital Of Misappropriating Funds

This could be accomplished by way of a trusted supply, or by way of proof of burn. Once the staking has began up, and all nodes are synced with the blockchain, proof of stake turns into safe and absolutely decentralized.

PoS blockchains are much less power-intensive than proof of labour blockchains, such as Bitcoin, as an outcome of in contrast to PoW networks, they don’t require large computing power to validate new blocks. Instead, nodes — servers that process transactions — on a PoS blockchain are used to validate transactions and act as checkpoints.

Ethereum’s DeFi purposes are sometimes described as “money legos” as an end result of users can stack activities across multiple purposes in limitless mixtures, almost like lego bricks.

The views and opinions expressed by the creator are for informational purposes only and do not represent financial, funding, or different recommendation. Borrowing funds on Compound supplies COMP Token as a form of cashback.

Deposited funds are usually stablecoins linked to USD, similar to DAI, USDT, USDC, and extra. Curve protocol makes use of a unique market-making algorithm to make sure low fees and minimal slippage.

Constant product formulation to hold up price ratios and lots of DEX platforms make the most of fashions with varying degrees of similarity.

SGo To Pool On The Highest Header And Choose The Pool That You Would Like To Add Liquidity To

Aave has the highest TVL locked amongst all DeFi protocols, sitting at over $21 billion as of August 2021. If you’re already planning to hold a cryptocurrency long-term, you may as well look to increase the return you might get on these holdings.

Staking and lending present a low-risk method to generate further returns, earned in the same cryptocurrency you already maintain. Participating in a liquidity pool can produce even larger earnings, however it carries extra danger.

While not exhaustive, the record beneath contains a variety of core yield farming platforms. When buyers stake cryptocurrency, they lock in cash as a method of supporting the safety of the cryptocurrency as a complete.

Staking is just like purchasing shares in an enterprise because buyers get rewarded for staking coins based on the cash’ market performance.

Trending Cash

Instead of simply having your cryptocurrency stored in a pockets, you’ll find a way to successfully earn extra crypto by yield farming. Yield farmers can earn from transaction charges, token rewards, interest, and value appreciation.

Yield farming is also a reasonable different to mining — since you don’t have to buy expensive mining equipment or pay for electrical energy. At its core, yield farming is a process that permits cryptocurrency holders to lock up their holdings, which in flip offers them with rewards.

When buyers participate in yield farming, their cryptocurrency worth grows over time. At probably the most fundamental stage, yield farming is a method of earning charges by lending cryptocurrency through smart contracts. As one of many largest DeFi platforms, it has almost $16 billion dollars in its ecosystem.

Yield farming is an funding technique in decentralised finance or DeFi. This pool powers a market where users can lend, borrow, or exchange tokens. The usage of those platforms incurs fees, which are then paid out to liquidity providers based on their share of the liquidity pool. Although yield farming offers enticing yields by simply depositing the token to protocols.

However, it’s not a risk-free recreation and buyers ought to bear in mind the potential dangers, including impermanent loss and good contract threat. Our new product, token.com, will leverage yield farming by accessing the outsized returns provided in DeFi.

Yield Farming In Defi: All You Have To Know

It could be an opportunity for the daring to win massive — or for the holders of latest currencies to manipulate costs.

The U.S. Securities and Exchange Commission has put the business on discover that it has reservations, in particular over whether the apply ought to be regulated as a securities offering.

Uniswap pays out the payment it collects from exchanges to liquidity providers.

Start Your Crypto Journey

Yield farmers are individuals who become “liquidity suppliers” by adding their crypto right into a liquidity pool on a decentralized exchange .

They earn charges paid by customers who borrow and swap tokens on that DeFi platform. See IFO, DeFi, decentralized exchange, crypto glossary and cryptocurrency.

Decentralised finance, rising monetary know-how that goals to remove intermediaries in monetary transactions, has opened up a quantity of avenues of income for investors.

It includes lending or staking your cryptocurrency coins or tokens to get rewards in the type of transaction fees or interest.

Examples Of Yield Farming Platforms

Beware of ludicrously high-interest estimates, and all the time vet DeFi platforms earlier than investing. Overall, we hope this comparison for yield farming vs. staking has been helpful for you.

Staking and yield farming are nonetheless relatively new passive income methods when in comparison with approaches utilized in other monetary markets.

At occasions, the terms are used interchangeably, and staking might even be thought of a subset of yield farming.

Both approaches to income passive revenue depend on holding crypto belongings to earn rewards, and each strategy permits traders to share in the value of the decentralized monetary ecosystem.

Is Yield Farming For You?

If the investor chooses a network that’s still growing, then can passively invest in cryptocurrencies by following the network’s development and holding the growing coin.

Cryptocurrency might have started out as a Wild West of investing dominated by mavericks, nevertheless it’s now firmly within the financial mainstream.

Our in-house analysis group and on-site financial specialists work together to create content that’s correct, impartial, and updated. We fact-check each single statistic, quote and truth using trusted main sources to ensure the information we offer is correct.

You can be taught more about GOBankingRates’ processes and requirements in our editorial policy. Many of the provides appearing on this website are from advertisers from which this website receives compensation for being listed right here.

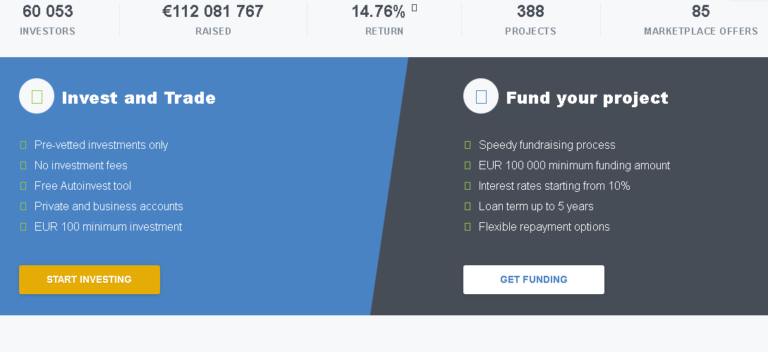

Staking supplies returns ranging from 5% to 12%, whereas yield farming supplies higher APY rates. Platforms like as Uniswap, Pancake Swap, Aave, and Curve Finance provide annual share charges ranging from 2.5 % to 250 per cent.

Yield farming is a method of generating additional cryptocurrency along with your current cryptocurrency. It entails you lending your cash to others through the ability of computer packages known as smart contracts.

The funds deposited are commonly stablecoins pegged to the USD – although this isn’t a basic requirement. Some of the commonest stablecoins utilized in DeFi are DAI, USDT, USDC, BUSD, and others.

Some protocols will mint tokens that characterize your deposited cash within the system. For instance, if you deposit DAI into Compound, you’ll get cDAI, or Compound DAI. If you deposit ETH to Compound, you’ll get cETH.

What Began The Yield Farming Boom?

It also currently holds essentially the most liquidity of each software on Ethereum. Nonetheless, for now, yield farmers can profit from rates of interest that far surpass these paid by traditional banking providers.

Ethereum’s DeFi ecosystem allows users to lend, borrow, swap, and stake their property across a wide range of functions. DeFi is permissionless — anybody with an Internet connection can use an application like Uniswap or Aave as long as they download an Ethereum pocket.

Should I Start Yield Farming?

Due to the character of DeFi, many protocols are constructed and developed by small teams with restricted budgets. It’s also value maintaining in thought that these are solely estimations and projections.

Even short-term rewards are quite troublesome to estimate accurately. Yield farming is an extremely aggressive and fast-paced market, and the rewards can fluctuate rapidly.

Recommendation:

What’s The Metaverse? A Sort Of Easy Explainer

What Is Internet 3 Zero, And Why Is It An Important Technology For Business?

Discover more from Start Entrepreneur Online

Subscribe to get the latest posts sent to your email.